Adding deposits correctly in QuickBooks Online is crucial for accurate financial record-keeping, especially for online gaming businesses, and gmonline.net is here to guide you. We’ll explore the seamless integration of revenue streams, ensuring your financial statements reflect the vibrant activity of your gaming platform, optimizing your financial strategy, improving cash flow management, and fostering stronger relationships with players and partners in the gaming world.

1. What Is QuickBooks Online and Why Is It Important for Online Gaming Businesses?

QuickBooks Online is a cloud-based accounting software designed to help businesses manage their finances efficiently. It is crucial for online gaming businesses for several reasons:

- Financial Tracking: It allows businesses to track income, expenses, and cash flow in real-time.

- Tax Compliance: It helps in preparing accurate financial reports for tax purposes.

- Invoicing and Payments: It simplifies the process of sending invoices and receiving payments from customers.

- Reporting: It provides detailed reports on financial performance, helping businesses make informed decisions.

For a deeper understanding of QuickBooks Online and its features, refer to the official QuickBooks Online website.

1.1 How Does QuickBooks Online Help Streamline Financial Operations for Gaming Platforms?

QuickBooks Online streamlines financial operations for gaming platforms by automating many of the manual tasks associated with accounting. This includes:

- Automated Invoicing: Generating and sending invoices automatically, reducing administrative burden.

- Real-Time Tracking: Monitoring financial transactions as they occur, providing up-to-date insights into the business’s financial health.

- Integration with Payment Gateways: Seamlessly integrating with payment gateways to record transactions automatically, ensuring accuracy and efficiency.

1.2 What Are the Key Benefits of Using QuickBooks Online for Managing Finances in the Gaming Industry?

The key benefits of using QuickBooks Online in the gaming industry include:

- Improved Accuracy: Automating financial processes reduces the risk of human error, leading to more accurate financial records.

- Increased Efficiency: Streamlining financial tasks frees up time for businesses to focus on core activities such as game development and marketing.

- Better Financial Insights: Providing detailed reports and analytics that help businesses understand their financial performance and make informed decisions.

- Scalability: As the business grows, QuickBooks Online can scale to meet its changing needs, ensuring long-term financial stability.

1.3 How Can Gaming Businesses Leverage QuickBooks Online for Financial Planning and Forecasting?

Gaming businesses can leverage QuickBooks Online for financial planning and forecasting by:

- Analyzing Historical Data: Using historical financial data to identify trends and patterns that can inform future financial planning.

- Creating Budgets: Developing budgets and tracking performance against those budgets to ensure financial discipline.

- Forecasting Revenue: Predicting future revenue based on past performance and market trends, helping businesses make informed decisions about investments and resource allocation.

2. Setting Up Your QuickBooks Online Account for Gaming Revenue

Setting up your QuickBooks Online account correctly is essential for accurately tracking your gaming revenue.

2.1 How Do I Create a New Company File in QuickBooks Online?

To create a new company file in QuickBooks Online:

- Go to the QuickBooks Online website.

- Click on “Free Trial” or “Buy Now”.

- Follow the prompts to enter your business information, including name, industry, and location.

- Choose a subscription plan that meets your needs.

- Complete the setup process by configuring your account settings.

2.2 What Chart of Accounts Should I Use for an Online Gaming Business?

A chart of accounts is a list of all the accounts used to record financial transactions in your business. For an online gaming business, consider including the following accounts:

| Account Type | Account Name | Description |

|---|---|---|

| Income | Game Sales | Revenue generated from the sale of games. |

| Income | In-App Purchases | Revenue from virtual items, upgrades, or other in-game purchases. |

| Income | Subscription Fees | Revenue from users who pay a recurring fee to access the game. |

| Income | Advertising Revenue | Income earned from displaying advertisements within the game. |

| Cost of Goods Sold | Game Development Costs | Expenses related to the creation of the game, including salaries, software licenses, and outsourcing costs. |

| Operating Expenses | Marketing and Advertising Expenses | Costs associated with promoting the game, such as online ads, social media campaigns, and influencer partnerships. |

| Operating Expenses | Server and Hosting Costs | Expenses related to maintaining the servers that host the game. |

| Operating Expenses | Customer Support Expenses | Costs associated with providing customer support, such as salaries, software, and outsourcing. |

| Assets | Cash and Bank Accounts | Money held in bank accounts. |

| Assets | Accounts Receivable | Money owed to the business by customers. |

| Liabilities | Accounts Payable | Money owed by the business to suppliers. |

| Equity | Owner’s Equity | The owner’s investment in the business. |

| Other Income/Expense | Interest Income | Income earned from interest on bank accounts or investments. |

| Other Income/Expense | Bank Charges | Fees charged by the bank for various services. |

| Other Income/Expense | Payment Processing Fees | Fees charged by payment processors for handling online payments. |

| Other Income/Expense | Foreign Exchange Gains/Losses | Gains or losses resulting from fluctuations in exchange rates when dealing with foreign currencies. |

| Other Assets | Prepaid Expenses | Expenses paid in advance, such as insurance premiums or software subscriptions. |

| Fixed Assets | Computer Equipment | Physical assets used in the business, such as computers and servers. |

| Long-Term Liabilities | Loans Payable | Money owed to lenders, such as banks or investors. |

| Equity | Retained Earnings | Accumulated profits of the business that have not been distributed to owners. |

| Cost of Goods Sold | Royalties | Payments made to game developers or licensors based on game sales. |

| Operating Expenses | Legal and Professional Fees | Expenses for legal services or consulting. |

| Other Income/Expense | Grants and Subsidies | Income received from government or other organizations to support game development. |

| Income | Merchandise Sales | Revenue from selling merchandise related to the game. |

| Income | Event Tickets | Revenue from ticket sales for gaming events or tournaments. |

| Cost of Goods Sold | Content Creation Costs | Expenses related to creating additional content for the game, such as new levels or characters. |

| Operating Expenses | Community Management Expenses | Costs associated with managing the game’s online community, such as salaries, software, and moderation tools. |

| Operating Expenses | Localization Expenses | Costs associated with translating the game into different languages for international markets. |

| Assets | Intellectual Property (Game Assets) | Intangible assets representing the value of the game’s intellectual property. |

| Liabilities | Deferred Revenue (Unearned Revenue) | Revenue received in advance for services or products to be delivered in the future. |

| Other Income/Expense | Sponsorship Income | Income received from sponsors who support the game or gaming events. |

| Other Income/Expense | Crowdfunding Income | Income received through crowdfunding platforms to support game development. |

| Income | eSports Prizes | Revenue from winning eSports tournaments or competitions. |

| Operating Expenses | eSports Team Expenses | Costs associated with maintaining an eSports team, such as salaries, travel expenses, and equipment. |

| Other Income/Expense | Training and Development Expenses | Costs associated with training employees or eSports team members to improve their skills. |

| Income | Game Licensing Fees | Revenue from licensing the game to other companies or platforms. |

| Cost of Goods Sold | Quality Assurance and Testing Expenses | Costs associated with ensuring the game is of high quality and free from bugs. |

| Operating Expenses | Data Analytics and Reporting Expenses | Costs associated with analyzing game data to improve gameplay and user experience. |

| Assets | Cryptocurrency (if accepting as payment) | Digital currency held as an asset if accepting cryptocurrency payments. |

| Liabilities | Cryptocurrency Payable (if owing) | Obligation to pay using cryptocurrency. |

| Other Income/Expense | Cryptocurrency Gains/Losses (if trading) | Profits or losses from trading cryptocurrency. |

2.3 How Do I Customize My QuickBooks Online Settings for Online Gaming Transactions?

To customize your QuickBooks Online settings:

-

Go to Settings ⚙ and select Account and Settings.

-

Customize settings such as:

- Company: Update your company information, such as name, address, and industry.

- Sales: Customize your sales forms, such as invoices and sales receipts.

- Expenses: Set up expense tracking preferences, such as default categories and payment methods.

- Payments: Configure your payment processing options to accept online payments.

- Advanced: Adjust advanced settings such as accounting method, chart of accounts, and automation preferences.

3. Recording Different Types of Deposits in QuickBooks Online

Accurately recording different types of deposits is critical for maintaining accurate financial records.

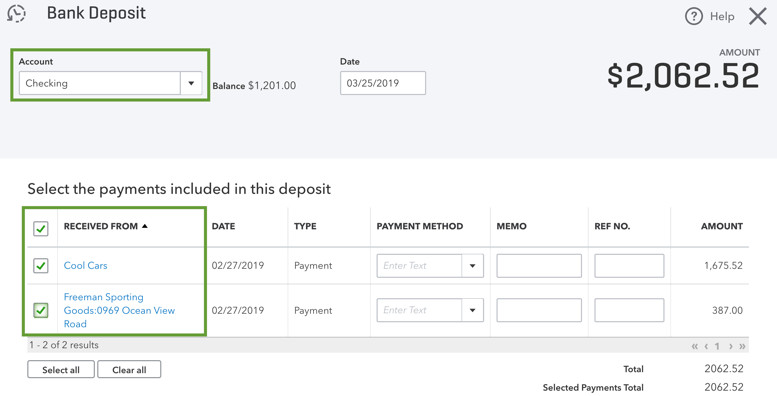

3.1 How Do I Record Game Sales Deposits?

To record game sales deposits:

- Go to + New and select Bank Deposit.

- Choose the bank account where the deposit was made.

- Select the payments you want to combine into the deposit.

- Ensure the total matches your deposit slip.

- Select Save and close.

Bank deposit screen with deposits on the page

Bank deposit screen with deposits on the page

3.2 How Do I Record In-App Purchase Deposits?

To record in-app purchase deposits:

- Go to + New and select Sales Receipt.

- Choose the customer (or create a new one if necessary).

- Enter the items purchased and the amounts.

- Select the payment method and bank account.

- Select Save and close.

3.3 How Do I Record Subscription Fee Deposits?

To record subscription fee deposits:

- Go to + New and select Recurring Sales Receipt.

- Set up a recurring sales receipt template for each subscription plan.

- Enter the customer information, items, and amounts.

- Set the schedule for the recurring transaction.

- Select Save template.

3.4 How Do I Record Advertising Revenue Deposits?

To record advertising revenue deposits:

- Go to + New and select Invoice.

- Choose the advertiser as the customer.

- Enter the advertising services provided and the amounts.

- Send the invoice to the advertiser.

- Once payment is received, record the deposit using the Bank Deposit feature.

4. Utilizing Undeposited Funds for Accurate Recording

Using the Undeposited Funds account is crucial for matching your QuickBooks records with your bank statements.

4.1 What Are Undeposited Funds and How Do They Work?

Undeposited Funds is a temporary account in QuickBooks Online that holds payments before you deposit them into your bank account. This account allows you to combine multiple transactions into a single deposit, matching how your bank records the deposit.

4.2 How Do I Move Transactions to the Undeposited Funds Account?

To move transactions to the Undeposited Funds account:

- When recording a payment, select Undeposited Funds as the deposit account.

- This will hold the payment in the Undeposited Funds account until you are ready to make a bank deposit.

4.3 How Do I Combine Multiple Transactions into a Single Bank Deposit Using Undeposited Funds?

To combine multiple transactions into a single bank deposit:

- Go to + New and select Bank Deposit.

- Choose the bank account where the deposit was made.

- Select the transactions from the Undeposited Funds account that you want to include in the deposit.

- Ensure the total matches your deposit slip.

- Select Save and close.

5. Handling Fees and Charges in QuickBooks Online

Properly handling fees and charges is essential for accurate financial reporting.

5.1 How Do I Record Payment Processing Fees?

To record payment processing fees:

- Go to + New and select Expense.

- Choose the payment processor as the vendor.

- Select the Bank Charges account.

- Enter the amount of the fee.

- Select Save and close.

5.2 How Do I Record Bank Service Charges?

To record bank service charges:

- Go to + New and select Expense.

- Choose the bank as the vendor.

- Select the Bank Charges account.

- Enter the amount of the charge.

- Select Save and close.

5.3 How Do I Handle Currency Conversion Fees?

To handle currency conversion fees:

- Record the deposit in the original currency.

- Use the Exchange Rate field to enter the conversion rate.

- QuickBooks Online will automatically calculate the converted amount.

- Record any currency conversion fees as an expense using the Bank Charges account.

6. Reconciling Bank Deposits in QuickBooks Online

Reconciling bank deposits is crucial for ensuring the accuracy of your financial records.

6.1 What Is Bank Reconciliation and Why Is It Important?

Bank reconciliation is the process of comparing your bank statement to your QuickBooks Online records to ensure they match. It is important because it helps you:

- Identify errors or discrepancies in your records.

- Detect unauthorized transactions or fraud.

- Ensure the accuracy of your financial statements.

6.2 How Do I Reconcile My Bank Account in QuickBooks Online?

To reconcile your bank account:

- Go to Settings ⚙ and select Reconcile.

- Choose the bank account you want to reconcile.

- Enter the ending balance and ending date from your bank statement.

- Match the transactions in QuickBooks Online to the transactions on your bank statement.

- If there are any discrepancies, investigate and resolve them.

- Once everything matches, select Finish now.

6.3 What Should I Do If There Are Discrepancies During Reconciliation?

If there are discrepancies during reconciliation:

- Review your bank statement and QuickBooks Online records for errors.

- Check for missing transactions or duplicate entries.

- Investigate any unauthorized transactions or fraud.

- If you cannot resolve the discrepancies, consult with an accountant or bookkeeper.

7. Generating Financial Reports for Gaming Businesses

Generating financial reports is essential for understanding your business’s financial performance.

7.1 What Financial Reports Are Most Important for Online Gaming Businesses?

The most important financial reports for online gaming businesses include:

- Profit and Loss Statement: Shows your revenue, expenses, and net income over a period of time.

- Balance Sheet: Shows your assets, liabilities, and equity at a specific point in time.

- Cash Flow Statement: Shows the movement of cash in and out of your business over a period of time.

- Sales Report: Provides detailed information about your sales, including revenue by product, customer, and region.

- Expense Report: Provides detailed information about your expenses, including costs by category, vendor, and period.

7.2 How Do I Generate a Profit and Loss Statement in QuickBooks Online?

To generate a Profit and Loss statement:

- Go to Reports and select Profit and Loss.

- Choose the reporting period.

- Customize the report as needed.

- Select Run report.

7.3 How Can I Use Financial Reports to Improve My Gaming Business’s Profitability?

You can use financial reports to improve your gaming business’s profitability by:

- Identifying areas where you can reduce expenses.

- Analyzing revenue trends to identify opportunities for growth.

- Tracking key performance indicators (KPIs) to measure your business’s performance.

- Making informed decisions about pricing, marketing, and product development.

8. Integrating QuickBooks Online with Other Gaming Business Tools

Integrating QuickBooks Online with other tools can streamline your financial processes and improve efficiency.

8.1 What Tools Can I Integrate with QuickBooks Online?

You can integrate QuickBooks Online with a variety of tools, including:

- Payment Gateways: PayPal, Stripe, Authorize.net

- CRM Systems: Salesforce, HubSpot

- E-commerce Platforms: Shopify, WooCommerce

- Project Management Tools: Asana, Trello

- Payroll Services: Gusto, ADP

8.2 How Do I Integrate Payment Gateways with QuickBooks Online?

To integrate payment gateways:

- Go to Settings ⚙ and select Apps.

- Search for the payment gateway you want to integrate.

- Follow the prompts to connect your accounts.

8.3 What Are the Benefits of Integrating My Gaming Business Tools with QuickBooks Online?

The benefits of integrating your gaming business tools include:

- Automated Data Entry: Automatically sync data between systems, reducing manual data entry.

- Improved Accuracy: Ensure data consistency across all your systems.

- Increased Efficiency: Streamline processes and save time.

- Better Visibility: Gain a holistic view of your business operations.

9. Best Practices for Managing Deposits in QuickBooks Online for Online Gaming

Following best practices is essential for effectively managing deposits.

9.1 What Are Some Common Mistakes to Avoid When Recording Deposits?

Common mistakes to avoid include:

- Failing to use the Undeposited Funds account.

- Incorrectly categorizing transactions.

- Not reconciling bank deposits regularly.

- Ignoring fees and charges.

- Not keeping accurate records.

9.2 How Often Should I Reconcile My Bank Accounts?

You should reconcile your bank accounts at least monthly.

9.3 What Records Should I Keep for Audit Purposes?

You should keep the following records for audit purposes:

- Bank statements

- Deposit slips

- Invoices

- Sales receipts

- Expense reports

- Financial reports

10. Advanced Tips and Tricks for QuickBooks Online Users in the Gaming Industry

For advanced users, here are some tips and tricks.

10.1 How Can I Use Classes and Locations to Track Revenue and Expenses by Game?

Classes and locations allow you to track revenue and expenses by game or location. To use classes and locations:

- Go to Settings ⚙ and select All Lists.

- Choose Classes or Locations.

- Create a class or location for each game or location.

- Assign transactions to the appropriate class or location.

10.2 How Do I Set Up Budgets in QuickBooks Online?

To set up budgets:

- Go to Settings ⚙ and select Budgeting.

- Create a new budget.

- Enter your budgeted amounts for each account.

- Save the budget.

10.3 How Can I Use QuickBooks Online to Track Key Performance Indicators (KPIs) for My Gaming Business?

You can use QuickBooks Online to track KPIs by:

- Creating custom reports to track metrics such as revenue per user, customer acquisition cost, and churn rate.

- Using dashboards to visualize your KPIs.

- Setting up alerts to notify you when KPIs fall below target levels.

11. The Future of Financial Management for Online Gaming

The future of financial management is evolving.

11.1 What Are the Emerging Trends in Financial Management for Online Gaming?

Emerging trends include:

- Cryptocurrency Integration: Accepting and managing cryptocurrency payments.

- AI-Powered Automation: Using AI to automate financial tasks.

- Real-Time Analytics: Gaining real-time insights into financial performance.

- Cloud-Based Solutions: Leveraging cloud-based solutions for flexibility and scalability.

11.2 How Can Gaming Businesses Prepare for These Changes?

Gaming businesses can prepare by:

- Staying informed about emerging trends and technologies.

- Investing in training and education for their finance teams.

- Adopting cloud-based accounting solutions.

- Integrating AI-powered tools into their financial processes.

11.3 How Will gmonline.net Continue to Support Online Gaming Businesses with Their Financial Needs?

gmonline.net will continue to support online gaming businesses by:

- Providing up-to-date information and resources on financial management.

- Offering expert advice and guidance.

- Developing innovative solutions to meet the evolving needs of the industry.

By following these guidelines and best practices, online gaming businesses can effectively manage their deposits in QuickBooks Online, ensuring accurate financial records and improved financial performance. If you want to learn more, visit gmonline.net for all your gaming needs at Address: 10900 Wilshire Blvd, Los Angeles, CA 90024, United States. Phone: +1 (310) 235-2000, or at our Website.

FAQ: Adding Deposits in QuickBooks Online

1. How do I add a deposit in QuickBooks Online?

To add a deposit, go to + New, then select Bank Deposit. Choose the account, select payments from Undeposited Funds, ensure the total matches your deposit slip, and save.

2. What is the Undeposited Funds account in QuickBooks Online?

The Undeposited Funds account is a temporary holding account for payments before they are deposited into your bank account, allowing you to combine multiple transactions into a single deposit.

3. How do I move transactions to the Undeposited Funds account?

When recording a payment, select Undeposited Funds as the deposit account to hold the payment until you make a bank deposit.

4. How do I combine multiple transactions into a single bank deposit using Undeposited Funds?

Go to + New, select Bank Deposit, choose the bank account, select transactions from Undeposited Funds, ensure the total matches your deposit slip, and save.

5. How do I record payment processing fees in QuickBooks Online?

To record payment processing fees, go to + New, select Expense, choose the payment processor as the vendor, select the Bank Charges account, enter the fee amount, and save.

6. How do I reconcile my bank account in QuickBooks Online?

Go to Settings ⚙, select Reconcile, choose the bank account, enter the ending balance and date, match transactions, resolve discrepancies, and finish.

7. What should I do if there are discrepancies during reconciliation?

Review your bank statement and QuickBooks records, check for missing or duplicate transactions, investigate unauthorized transactions, and consult an accountant if needed.

8. How do I generate a Profit and Loss statement in QuickBooks Online?

Go to Reports, select Profit and Loss, choose the reporting period, customize as needed, and run the report.

9. How can I use financial reports to improve my gaming business’s profitability?

Identify expense reduction areas, analyze revenue trends, track KPIs, and make informed decisions about pricing, marketing, and product development.

10. How do I integrate payment gateways with QuickBooks Online?

Go to Settings ⚙, select Apps, search for the payment gateway, and follow the prompts to connect your accounts.

11. What are the benefits of integrating my gaming business tools with QuickBooks Online?

Automated data entry, improved accuracy, increased efficiency, and better visibility across your business operations.

12. What are some common mistakes to avoid when recording deposits?

Avoid failing to use Undeposited Funds, incorrectly categorizing transactions, not reconciling regularly, ignoring fees, and not keeping accurate records.

13. How often should I reconcile my bank accounts?

Reconcile your bank accounts at least monthly for accurate financial tracking.

14. How can I use classes and locations to track revenue and expenses by game?

Go to Settings ⚙, select All Lists, choose Classes or Locations, create a class or location for each game, and assign transactions accordingly.

15. How can I use QuickBooks Online to track key performance indicators (KPIs) for my gaming business?

Create custom reports, use dashboards to visualize KPIs, and set up alerts for when KPIs fall below target levels.

By following these steps, you’ll be well-equipped to manage your deposits effectively in QuickBooks Online. For more expert advice and assistance, gmonline.net is always here to help!