Many taxpayers might be unaware that they can easily request, receive, and review their tax records for free from the IRS through tax transcripts. As Part I of this series explained, IRS transcripts are frequently used to validate income and tax filing status for various financial applications like mortgages, student loans, social services, and small business loans. They are also essential when responding to IRS notices, filing amended returns, or resolving lien releases. Furthermore, transcripts are invaluable for taxpayers preparing and filing their annual tax returns, helping to verify estimated tax payments, Advance Child Tax Credits, Economic Impact Payments (stimulus payments), and prior year overpayments.

Deciphering Your IRS Transcript: Understanding the Codes

While IRS transcripts offer significant benefits, understanding them can be challenging. The IRS’s Integrated Data Retrieval System (IDRS), which processes tax information, employs a system of Transaction Codes (TCs). These codes track IRS actions and processing steps on a taxpayer’s account. Essentially, TCs are processing instructions for the IRS system. To aid public understanding, the IRS provides descriptions for each TC on a taxpayer’s transcript. However, these descriptions are sometimes insufficient to fully clarify the transaction. For a more detailed explanation, taxpayers can refer to Document 11734, Transaction Code Pocket Guide (Obsolete), a summarized TC list derived from section 8A of the IRS’s Document 6209, ADP and IDRS Information Reference Guide. Both documents can be valuable resources when reviewing your IRS transcript.

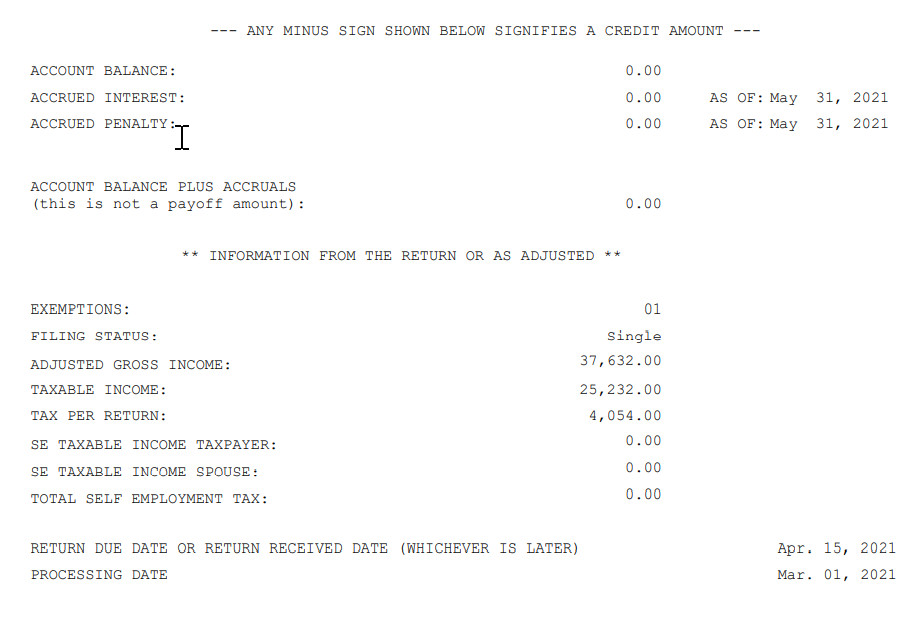

Understanding the IRS Record of Account Transcript

As illustrated in the example below, the Record of Account Transcript starts with a summary of any balance due or overpayment for the specified tax year. If there’s a balance due, the transcript indicates the date up to which penalties and interest have been calculated. Subsequently, the transcript details information from the taxpayer’s original return, including any corrections made due to taxpayer requests or IRS adjustments. This is particularly important for taxpayers needing to file an amended return. Form 1040X, Amended U.S. Individual Income Tax Return, requires accurate starting figures from the original return, as reflected in the transcript, to avoid processing complications.

Figure 1 Example of an IRS Record of Account Transcript, showing balance due and calculated penalties

Example of an IRS Record of Account Transcript, showing balance due and calculated penalties

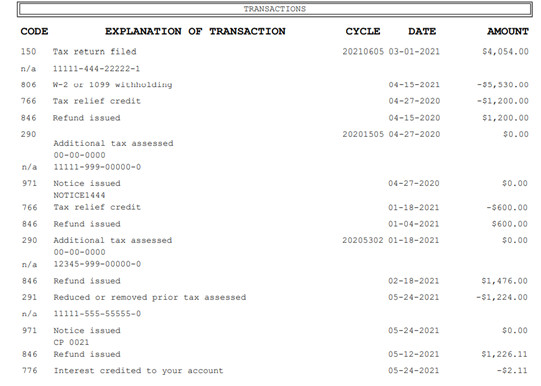

Navigating the Tax Account Section of Your Transcript

The Tax Account portion of the Record of Accounts Transcript, depicted in Figure 2, provides a breakdown of the taxpayer’s account activity.

Figure 2  Example of the Tax Account Portion of the Record of Accounts Transcript, detailing transaction codes and account activities

Example of the Tax Account Portion of the Record of Accounts Transcript, detailing transaction codes and account activities

Common Transaction Codes (TCs) found in this section include:

- TC 150: Indicates the filing date and the original tax amount reported on the return, or the IRS-corrected amount post-processing.

- TC 196: Shows assessed interest.

- TC 276: Represents penalties for failure to pay taxes.

- TC 291: Indicates abatement of prior tax assessments.

- TC 300: Reflects additional tax or deficiency assessments from IRS examinations or collections.

- TC 420: An Examination Indicator signifying a return is under review, potentially leading to an audit.

- TC 428: Shows case transfer for examination or appeals.

- TC 460: Indicates an extension of time to file.

- TC 480: Shows an Offer in Compromise is pending.

- TC 494: Represents a Notice of Deficiency.

- TC 520: Indicates IRS litigation has begun.

- TC 530: Signifies the account is currently not collectible.

- TC 582: A Lien Indicator.

- TC 768: Earned Income Credit.

- TC 806: Reflects credits for withheld taxes, as reported on tax returns and information statements like Forms W-2 and 1099.

- TC 846: Represents a tax refund issuance if credits and withholdings exceed the tax due, assuming no return issues.

It’s important to note that on the tax account transcript, credits, withholdings, interest credited by the IRS to the taxpayer, and tax adjustments that reduce the tax owed are displayed as negative amounts. Therefore, negative amounts on an IRS transcript generally indicate amounts that are beneficial to the taxpayer.

Because TCs are essentially system instructions, some are informational and not directly associated with a dollar amount. For further clarity, the IRS Pocket Guide can be a helpful resource for understanding transcript details.

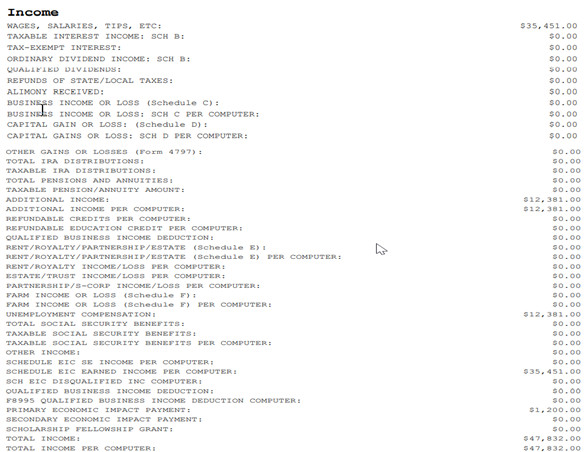

Examining the Tax Return Portion of the Record of Accounts

The tax return portion of the Record of Accounts transcript details most line entries from the taxpayer’s filed tax return. Figure 3 shows the income section from our example, but a complete Record of Accounts will include all sections of the filed return. This portion is particularly useful if a taxpayer lacks a personal copy of their return and needs to verify what was originally reported to the IRS.

Figure 3  Example of the Tax Return Portion of the Record of Accounts transcript, showing income details from the tax return

Example of the Tax Return Portion of the Record of Accounts transcript, showing income details from the tax return

Enhanced Security: New Transcript Format and Customer File Numbers

In July 2021, the IRS updated its online transcript system to enhance taxpayer data security, introducing a new transcript format and the use of a “customer file number.” The new format partially masks Personally Identifiable Information (PII) while keeping financial data visible for tax preparation, representation, and income verification purposes. These security measures apply to both individual and business taxpayer transcripts.

The new format displays the following information:

- Last four digits of Social Security Numbers (SSNs): XXX-XX-1234

- Last four digits of Employer Identification Numbers (EINs): XX-XXX1234

- Last four digits of account or telephone numbers

- First four characters of first and last names (first three if the name is shorter)

- First four characters of business names (first three if shorter)

- First six characters of street addresses, including spaces

- Full visibility of all monetary amounts

For security reasons, the IRS has discontinued fax services for most transcript types and eliminated third-party mailing via Forms 4506, 4506-T, and 4506T-EZ.

Lenders and other entities that previously used Form 4506 series for income verification should explore alternatives like the Income Verification Express Service (IVES) or request that customers provide their transcripts directly.

Individual taxpayers can utilize the Get Transcript Online or Get Transcript by Mail services. To further enhance security with the masked Taxpayer Identification Numbers, the IRS implemented the Customer File Number. This optional ten-digit number, assigned by a third party like a lender (e.g., a loan number), can be manually entered by the taxpayer when requesting a transcript online or by mail. This Customer File Number then appears on the downloaded or mailed transcript, acting as a tracking number for third parties to match the transcript to the correct taxpayer request.

Conclusion: Accessing Your IRS Tax Transcripts Online

For taxpayers needing tax return, tax account, or information return details, the IRS’s Get Transcript Online portal and online accounts offer a fast and efficient solution. Expanding the functionality and accessibility of Online Accounts for tax professionals and businesses remains a crucial step for the IRS. The current online transcript services are invaluable, providing essential information readily. Tax transcripts are a free resource offering a wealth of data. Taxpayers are encouraged to explore this option as a first step. Obtaining an IRS transcript online can often be a quicker and more convenient alternative to contacting the IRS directly or using more time-consuming methods for accessing tax account information.