Many people are unaware that they can easily request, receive, and review their tax records through a tax transcript from the IRS, completely free of charge. As previously discussed, IRS transcripts play a crucial role in verifying income and tax filing status for various financial processes, such as mortgage applications, student loan requests, applications for social services, and small business loans. They are also essential when responding to IRS notices, filing amended tax returns, or obtaining a lien release. Furthermore, taxpayers find transcripts invaluable during tax preparation and filing, as they allow for verification of estimated tax payments, Advance Child Tax Credits, Economic Impact Payments (stimulus payments), and prior year overpayments.

Decoding Your IRS Tax Transcript: Reading and Comprehension

While IRS transcripts offer significant benefits, deciphering them can be challenging. The IRS’s processing system, known as the Integrated Data Retrieval System (IDRS), employs a coding system to identify each transaction and maintain a detailed history of actions applied to a taxpayer’s account. These Transaction Codes (TCs) essentially serve as processing instructions within the IRS system. To enhance user-friendliness for taxpayers, the IRS provides literal descriptions for each TC appearing on a transcript. However, these descriptions sometimes fall short of fully explaining the intricacies of an account transaction. For more in-depth information, Document 11734, Transaction Code Pocket Guide (Obsolete), offers a summarized list of TCs extracted from section 8A of the IRS’s Document 6209, ADP and IDRS Information Reference Guide. Both documents can be valuable resources when meticulously reviewing your IRS transcript.

In-Depth Look at the IRS Record of Account Transcript

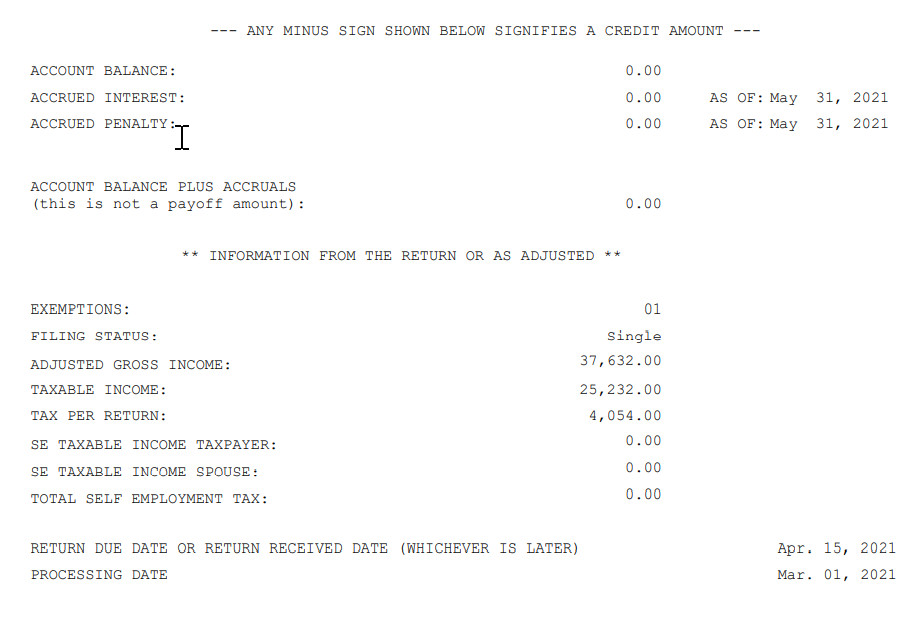

As illustrated in the sample Record of Account Transcript below, a summary of any outstanding balance or overpayment for the specified tax year is prominently displayed at the top. If a balance is due, the transcript specifies the date to which penalties and interest have been calculated. Subsequently, the transcript presents specific data extracted directly from your tax return, or any corrected figures resulting from amendments initiated by either the taxpayer or an IRS adjustment. This aspect is particularly important if you need to file an amended return. It’s crucial to use the IRS corrected figures as the starting point on Form 1040-X, Amended U.S. Individual Income Tax Return, when requesting any subsequent account adjustments to prevent potential processing complications.

Figure 1

Example of IRS Record of Account Transcript displaying balance and taxpayer data

Example of IRS Record of Account Transcript displaying balance and taxpayer data

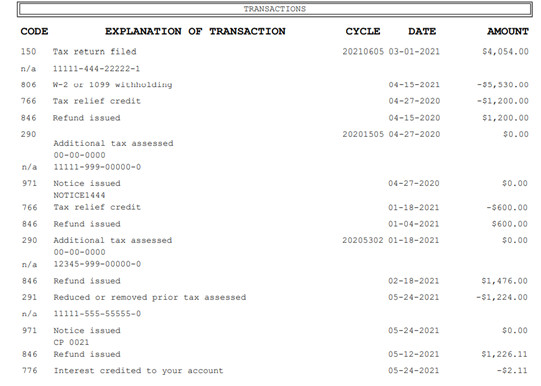

Understanding the Tax Account Portion of Your Transcript

This section of the Record of Accounts Transcript provides a detailed breakdown of your account activity, as demonstrated in Figure 2.

Figure 2

Detailed Tax Account Portion of the Record of Accounts Transcript showing transaction codes

Detailed Tax Account Portion of the Record of Accounts Transcript showing transaction codes

Several common TCs are typically found within the tax account section of a transcript:

- TC 150 – Indicates the date of filing and the amount of tax initially reported on your return, or as corrected by the IRS during processing.

- TC 196 – Shows assessed interest charges.

- TC 276 – Represents penalties for failure to pay taxes.

- TC 291 – Indicates abatement of a prior tax assessment.

- TC 300 – Signifies additional tax or deficiency assessments made by the Examination or Collection Divisions.

- TC 420 – An Examination Indicator, suggesting a return is under examination consideration, although it may not necessarily lead to a full audit.

- TC 428 – Indicates an Examination or Appeals Case Transfer.

- TC 460 – Reflects an extension of time granted for filing your return.

- TC 480 – Shows an Offer in Compromise is currently pending.

- TC 494 – Represents a Notice of Deficiency.

- TC 520 – Indicates IRS Litigation has been initiated.

- TC 530 – Signifies that an account is currently deemed not collectible by the IRS.

- TC 582 – A Lien Indicator, suggesting a tax lien has been placed.

- TC 768 – Represents the Earned Income Credit.

- TC 806 – Reflects credits for tax withheld, as reported on your tax return and information statements like Forms W-2 and 1099.

- TC 846 – Indicates the issuance of a tax refund when credits and withholdings exceed the tax due, assuming no issues with the return.

In the provided example, tax credits, withholding credits, credits for IRS interest owed to the taxpayer, and tax adjustments that decrease the tax liability are displayed as negative amounts on the tax account transcript. Therefore, negative amounts on an IRS transcript generally represent amounts that are favorable to the taxpayer.

Given that TCs are essentially instructions for the IRS system, it’s important to recognize that some TCs are used for informational purposes and are not directly associated with a specific dollar amount impacting your account balance.

Hopefully, this explanation has clarified the process. Utilizing the IRS’s Pocket Guide should further aid in understanding your transcript and locating the key information you require.

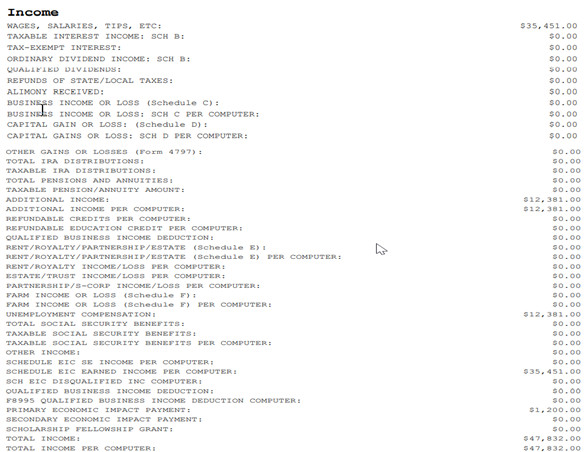

Exploring the Tax Return Portion of the Record of Accounts

The tax return portion of the Record of Accounts transcript mirrors most of the line entries from your original tax return as it was initially filed. Figure 3 displays the income section from our example; however, a complete Record of Accounts will encompass all sections of your filed tax return. This can be especially useful if you no longer have a personal copy of your tax return and need to verify what information was originally submitted to the IRS.

Figure 3

Example of Tax Return Portion of the Record of Accounts transcript showing income details

Example of Tax Return Portion of the Record of Accounts transcript showing income details

Understanding the New Tax Transcript Format and Customer File Number

In July 2021, the IRS updated its online resources to inform taxpayers about the new transcript format and the implementation of the “customer file number,” designed to enhance taxpayer data protection. This updated format partially masks Personally Identifiable Information (PII), while retaining visibility of crucial financial data necessary for tax preparation, tax representation, and income verification. These security enhancements apply to transcripts for both individual and business taxpayers.

Here’s what remains visible under the new, secure tax transcript format:

- The last four digits of any Social Security Number (SSN): XXX-XX-1234.

- The last four digits of any Employer Identification Number (EIN): XX-XXX1234.

- The last four digits of any account number or telephone number.

- The first four characters of the first name and the first four characters of the last name for individuals (or the first three characters if the name is shorter than four letters).

- The first four characters of any business name (or the first three characters if the name is shorter than four letters).

- The first six characters of the street address, including spaces.

- All monetary amounts, including wages, income figures, balance due amounts, interest, and penalties.

For enhanced security, the IRS has discontinued fax services for most transcript types for both taxpayers and third parties. Furthermore, the third-party mailing service via Forms 4506, 4506-T, and 4506T-EZ has also been stopped.

Lenders and other entities that previously relied on Form 4506 series to obtain transcripts for income verification should now explore alternative methods, such as participating in the Income Verification Express Service (IVES) or requesting that customers directly provide their transcripts.

Only individual taxpayers are eligible to utilize the Get Transcript Online or Get Transcript by Mail services. Due to the masking of the full Taxpayer Identification Number (TIN), the IRS introduced the Customer File Number. This ten-digit number, assigned by a third-party such as a lender (e.g., a loan number), can be manually entered when the taxpayer requests their transcript online or by mail. This Customer File Number will then appear on the downloaded or mailed transcript. The Customer File Number acts as a tracking mechanism, enabling lenders and other third parties to accurately match the transcript to the specific taxpayer who initiated the transcript request.

Conclusion: Accessing Your Tax Information Online is Easier Than Ever

Taxpayers seeking tax return, tax account, or information return details can efficiently find the information they need through the IRS’s Get Transcript Online portal or their IRS online account. The Irs Online Transcript service offers a free, quick, and secure way to access your tax records. It is a valuable tool for individuals and businesses alike. Utilizing the IRS online transcript system can often be a more efficient and less time-consuming method of obtaining tax information compared to contacting the IRS directly or using other, more cumbersome methods. Explore the IRS Get Transcript service today to simplify your access to essential tax data.