Are you struggling with duplicate accounts in QuickBooks Online and looking for a solution? This guide, brought to you by gmonline.net, will provide you with a comprehensive walkthrough on How To Merge Two Accounts In Quickbooks Online. Keep your financial data organized, streamline your bookkeeping, and improve overall efficiency with these simple steps. Let’s explore account cleanup and data migration strategies for better financial management.

1. Understanding the Importance of Merging Duplicate Accounts

Why is merging duplicate accounts crucial for your business’s financial health? Let’s dive into the benefits.

Having duplicate accounts, whether they are customer, vendor, or general ledger accounts, can lead to significant confusion and errors in your financial reporting. Merging these duplicates in QuickBooks Online is essential for maintaining accuracy and efficiency. A clean, organized accounting system not only speeds up bookkeeping processes but also provides a clearer picture of your company’s financial standing.

1.1. Streamlining Bookkeeping

How does merging duplicate accounts streamline your bookkeeping process?

Merging duplicate accounts eliminates the need to reconcile multiple entries for the same entity. This simplification reduces the time spent on manual tasks, allowing you to focus on more strategic aspects of your business. Accurate and consolidated data ensures that financial reports reflect the true state of affairs, enabling informed decision-making.

1.2. Reducing Errors

What kind of errors can duplicate accounts cause, and how does merging them help?

Duplicate accounts can lead to skewed financial data, resulting in incorrect reports and analyses. For example, if you have two customer accounts for the same client, revenue and payment tracking become fragmented. Merging these accounts consolidates all related transactions, preventing miscalculations and providing a comprehensive view of your financial interactions.

1.3. Improving Financial Reporting

In what ways does merging accounts improve the accuracy and clarity of your financial reports?

Consolidated data from merged accounts ensures that your financial reports provide a clear and accurate representation of your business’s performance. This accuracy is crucial for stakeholders, including investors, lenders, and internal management. Reliable financial reporting supports strategic planning, compliance, and overall business growth.

2. Preparing for the Merge

Before you start merging accounts in QuickBooks Online, careful preparation is key. Here’s a checklist to guide you:

Before diving into the merging process, it’s essential to take certain precautions to ensure data integrity. This preparation will help prevent any loss of important information and streamline the merging process, ensuring a smooth transition.

2.1. Identifying Duplicate Accounts

How do you effectively identify duplicate accounts in QuickBooks Online?

The first step is to identify the accounts that need merging. This involves a thorough review of your customer, vendor, and chart of accounts lists. Look for entries with similar names, contact information, or transaction histories. QuickBooks Online provides tools like search and filter options to help you quickly spot potential duplicates.

2.2. Backing Up Your Data

Why is backing up your data crucial before merging accounts?

Before making any significant changes to your QuickBooks Online data, it’s essential to create a backup. This safeguard ensures that you can restore your data in case of any unforeseen issues during the merging process. QuickBooks Online offers backup options that allow you to save a copy of your company file.

2.3. Understanding Account Types

What are the different account types in QuickBooks Online, and why is it important to understand them before merging?

QuickBooks Online categorizes accounts into different types, such as bank accounts, accounts receivable, and expense accounts. Understanding these categories is crucial because you can only merge accounts of the same type. Ensure that the accounts you plan to merge are compatible to avoid errors.

3. Step-by-Step Guide to Merging Accounts in QuickBooks Online

Ready to merge those duplicate accounts? Here’s a detailed walkthrough:

The process of merging accounts in QuickBooks Online involves several steps. It’s important to follow these steps carefully to ensure a successful merge and maintain the integrity of your financial data.

3.1. Merging Duplicate Chart of Accounts

How do you merge duplicate accounts in the Chart of Accounts?

The Chart of Accounts is where you manage your general ledger accounts. Here’s how to merge duplicate accounts:

- Open Chart of Accounts: Go to Settings and select Chart of Accounts.

- Edit Account: Find the account you want to keep, click the dropdown ▼ in the Action column, and select Edit. Note the Account Name, Account Type, and Detail Type.

- Modify Duplicate Account: Locate the duplicate account, click the dropdown ▼ in the Action column, and select Edit. Change the Account Name and Detail Type to match the account you want to keep.

- Save and Merge: Click Save and then Yes, merge accounts to confirm the merge.

3.2. Merging Duplicate Customer Accounts

What are the steps to merge duplicate customer accounts?

Merging customer profiles requires a slightly different approach:

- Identify the Main Customer: Determine which customer profile you want to keep.

- Edit the Duplicate Customer: Open the duplicate customer profile and change the name to match the main customer profile exactly.

- Save and Merge: When you save the changes, QuickBooks Online will prompt you to merge the accounts. Confirm the merge to combine the customer profiles.

3.3. Merging Duplicate Vendor Accounts

How do you merge duplicate vendor accounts in QuickBooks Online?

Merging vendor accounts is similar to merging customer accounts:

- Open Vendor List: Go to Expenses and select Vendors.

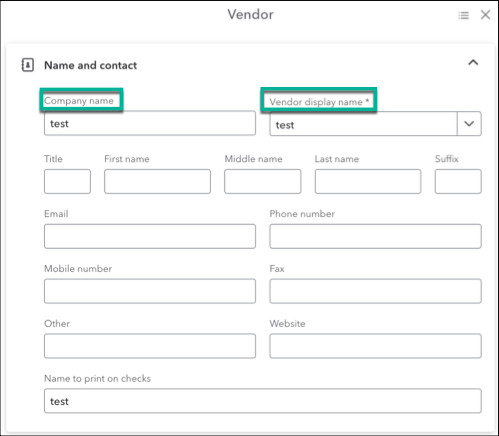

- Edit Vendor: Find and open the vendor profile you want to keep, then select Edit. Note the Company name and Vendor display name.

Vendor edit menu with highlights of the Company name and Vendor display name fields in QuickBooks Online.

Vendor edit menu with highlights of the Company name and Vendor display name fields in QuickBooks Online. - Modify Duplicate Vendor: Find the duplicate vendor profile and select Edit. Change the display name to match the vendor profile you want to keep.

- Save and Merge: Click Save, then Yes to confirm the merge.

4. Best Practices for Merging Accounts

To ensure a smooth and error-free merging process, follow these best practices:

To maintain data accuracy and prevent complications, adhere to these best practices when merging accounts in QuickBooks Online.

4.1. Double-Check Account Details

Why is it important to double-check account details before merging?

Before merging any accounts, carefully review the details of each account, including names, types, and transaction histories. This ensures that you are merging the correct accounts and that no important data is lost in the process.

4.2. Handle Subaccounts Properly

How do you handle subaccounts when merging accounts?

When merging accounts with subaccounts, ensure that the parent accounts are identical. If you’re merging two subaccounts, make sure they both have the same parent account. This prevents any disruption to your account hierarchy.

4.3. Review Transactions After Merging

What should you review in the transactions after merging accounts?

After merging accounts, review the consolidated transactions to ensure that everything has been transferred correctly. Look for any discrepancies or missing information and correct them as needed. This ensures that your financial reports remain accurate and reliable.

5. Common Issues and Troubleshooting

Encountering issues during the merging process? Here are some common problems and their solutions:

Even with careful preparation, you may encounter some challenges during the merging process. Here are some common issues and how to resolve them:

5.1. Unable to Merge Accounts

Why might you be unable to merge certain accounts?

Sometimes, QuickBooks Online may prevent you from merging certain accounts due to various reasons, such as different account types or linked transactions. Review the account details and transaction histories to identify the cause and take corrective action.

5.2. Data Loss During Merge

What should you do if you experience data loss during the merge?

If you notice any data loss after merging accounts, restore your QuickBooks Online data from the backup you created before the merge. Then, review the merging process and correct any errors to ensure that all data is transferred correctly.

5.3. Incorrect Account Types

How do you correct incorrect account types that prevent merging?

If you find that the account types are preventing you from merging accounts, you may need to adjust the account types to ensure compatibility. However, be cautious when changing account types, as this can affect your financial reporting.

6. Advanced Tips for Account Management

Take your account management skills to the next level with these advanced tips:

Beyond the basics of merging accounts, there are several advanced techniques you can use to optimize your account management in QuickBooks Online.

6.1. Using Classes and Locations

How can classes and locations help you manage your accounts better?

QuickBooks Online allows you to use classes and locations to track transactions by different segments of your business, such as departments or regions. By assigning classes and locations to your accounts, you can gain deeper insights into your financial performance and make more informed decisions.

6.2. Setting Up Recurring Transactions

What are recurring transactions, and how can they save you time?

Recurring transactions are automated entries that QuickBooks Online creates on a regular schedule. Setting up recurring transactions for common expenses or invoices can save you time and ensure that your accounts are always up to date.

6.3. Utilizing Bank Feeds

How can bank feeds help you reconcile your accounts more efficiently?

Bank feeds automatically import your bank and credit card transactions into QuickBooks Online, making it easier to reconcile your accounts. By linking your bank accounts to QuickBooks Online, you can reduce manual data entry and ensure that your financial records are accurate.

7. The Benefits of a Clean QuickBooks Online Account

What are the overall benefits of maintaining a clean and organized QuickBooks Online account?

Maintaining a clean and organized QuickBooks Online account offers numerous benefits for your business. From improved accuracy and efficiency to better financial insights, a well-managed accounting system can contribute to your overall success.

7.1. Improved Accuracy

How does a clean account improve the accuracy of your financial data?

A clean QuickBooks Online account ensures that your financial data is accurate and reliable. By eliminating duplicates, correcting errors, and reconciling accounts regularly, you can trust that your financial reports reflect the true state of your business.

7.2. Increased Efficiency

How does account cleanup increase the efficiency of your bookkeeping processes?

By streamlining your accounting system and automating routine tasks, you can save time and effort on bookkeeping. This increased efficiency allows you to focus on more strategic aspects of your business, such as growth and innovation.

7.3. Better Financial Insights

What kind of financial insights can you gain from a well-managed QuickBooks Online account?

A well-managed QuickBooks Online account provides valuable insights into your financial performance. By tracking your revenue, expenses, and profitability, you can identify trends, make informed decisions, and optimize your business strategies.

8. Staying Organized: Ongoing Account Maintenance

Merging duplicate accounts is just the beginning. How do you maintain a clean QuickBooks Online account in the long run?

Maintaining a clean QuickBooks Online account is an ongoing process. Here are some tips to help you stay organized:

8.1. Regular Reconciliation

Why is regular reconciliation important for maintaining account accuracy?

Reconciling your bank and credit card accounts regularly ensures that your QuickBooks Online data matches your actual financial transactions. This helps you identify and correct any discrepancies, preventing errors from accumulating over time.

8.2. Periodic Account Review

How often should you review your accounts, and what should you look for?

Set aside time each month to review your accounts for any unusual transactions or errors. Look for duplicate entries, incorrect classifications, and missing information. Addressing these issues promptly will keep your QuickBooks Online account clean and accurate.

8.3. Training and Documentation

Why is training important for everyone who uses QuickBooks Online?

Ensure that all users of QuickBooks Online are properly trained on how to enter and manage data. Provide documentation and guidelines to help them follow best practices and avoid common errors. This will contribute to the overall accuracy and efficiency of your accounting system.

9. Expert Insights on Account Management

What expert insights can help you optimize your account management practices?

To gain a deeper understanding of account management best practices, consider the insights from industry experts and resources.

9.1. Industry Resources

What are some reliable industry resources for account management tips?

Organizations like the American Institute of Certified Public Accountants (AICPA) and the National Association of Enrolled Agents (NAEA) offer valuable resources and guidance on account management. These resources can help you stay up-to-date on best practices and industry trends.

9.2. Consulting with Professionals

When should you consider consulting with a professional accountant or bookkeeper?

If you’re struggling to manage your accounts or need expert advice on complex financial matters, consider consulting with a professional accountant or bookkeeper. These professionals can provide personalized guidance and support to help you optimize your account management practices.

10. Frequently Asked Questions (FAQs) About Merging Accounts in QuickBooks Online

Have more questions? Check out these frequently asked questions:

10.1. Can I Undo a Merge in QuickBooks Online?

Is it possible to undo a merge after it has been completed?

No, merging accounts in QuickBooks Online is permanent and cannot be undone. This is why it’s crucial to back up your data before merging and to double-check all account details to ensure accuracy.

10.2. What Happens to Transactions After a Merge?

What happens to the transactions associated with the duplicate account after a merge?

All transactions from the duplicate account are moved to the account you choose to keep. This ensures that all historical data is consolidated into a single account for accurate reporting.

10.3. Can I Merge Different Account Types?

Is it possible to merge accounts with different account types?

No, you can only merge accounts of the same type. For example, you can merge two bank accounts or two expense accounts, but you cannot merge a bank account with an expense account.

10.4. How Do I Handle Opening Balance Equity Transactions?

What should I do if both accounts have opening balance equity transactions?

If both accounts have opening balance equity transactions, you’ll need to delete the transaction with the most recent date prior to merging. The older transaction becomes the opening balance of the newly merged account.

10.5. What If I Can’t Find the Merge Option?

What should I do if the merge option is not available in QuickBooks Online?

If you cannot find the merge option, ensure that you have the necessary permissions and that you are in the Accountant view. Also, verify that the accounts you are trying to merge are of the same type and do not have any restrictions preventing the merge.

10.6. Is It Possible to Merge More Than Two Accounts at Once?

Can I merge multiple duplicate accounts into one account simultaneously?

No, QuickBooks Online only allows you to merge two accounts at a time. If you have multiple duplicate accounts, you will need to repeat the merging process for each pair of accounts.

10.7. What Do I Do If the Account Name Is Slightly Different?

How precise do account names need to be for merging?

Account names must match exactly to initiate a merge. Even slight differences, such as extra spaces or abbreviations, can prevent the merge. Ensure the names are identical before proceeding.

10.8. How Long Does It Take to Merge Accounts?

What is the typical timeframe for merging accounts in QuickBooks Online?

The time it takes to merge accounts depends on the amount of data in the accounts. Simple merges can take just a few minutes, but more complex merges with a large transaction history may take longer.

10.9. Can I Merge Inactive Accounts?

Is it possible to merge inactive accounts with active accounts?

Yes, you can merge inactive accounts with active accounts. The transactions from the inactive account will be moved to the active account, and the inactive account will remain inactive.

10.10. Where Can I Find More Help with QuickBooks Online?

Where can I find additional resources and support for using QuickBooks Online?

You can find additional resources and support on the QuickBooks Online website, including tutorials, help articles, and community forums. You can also contact QuickBooks Online support directly for personalized assistance.

Summary

Merging duplicate accounts in QuickBooks Online is a critical step in maintaining accurate and efficient financial records. By following the steps outlined in this guide, you can streamline your bookkeeping processes, reduce errors, and gain better financial insights. Remember to back up your data, double-check account details, and regularly review your accounts to ensure ongoing accuracy. Stay organized, stay informed, and make the most of your QuickBooks Online experience.

For more information and helpful resources, visit gmonline.net, your ultimate destination for online gaming and esports news, guides, and community engagement. Dive into the world of competitive gaming, stay updated with the latest game releases, and connect with fellow gamers. At gmonline.net, we are dedicated to providing you with the tools and knowledge you need to excel both in the gaming world and in your business endeavors.

Stay connected with gmonline.net for the latest updates, expert tips, and community discussions. Your journey to financial clarity and gaming excellence starts here.

Address: 10900 Wilshire Blvd, Los Angeles, CA 90024, United States

Phone: +1 (310) 235-2000

Website: gmonline.net

Ready to take your QuickBooks Online account management to the next level? Visit gmonline.net now to read more news, find in-depth guides, and join our active community of gamers and business enthusiasts. Don’t miss out on the latest updates and expert tips—connect with us today and unlock your full potential!