Are you struggling with duplicate accounts in QuickBooks Online and looking for a solution? Merging accounts in QuickBooks Online is the answer, and gmonline.net is here to guide you through the process. This method streamlines your bookkeeping, prevents confusion, and ensures data accuracy. Discover how to merge accounts effectively, alongside tips on online gaming and Esports integration for optimized performance.

1. Understanding the Need to Merge Accounts in QuickBooks Online

Why would you need to merge accounts in QuickBooks Online? The most common reasons include:

- Duplicate Entries: Accidentally creating the same account more than once.

- Data Consolidation: Combining similar accounts for better reporting.

- Organizational Clarity: Streamlining your chart of accounts for easier management.

Merging accounts helps maintain accurate financial records and simplifies bookkeeping tasks.

1.1. What Happens When You Merge Accounts?

When you merge accounts in QuickBooks Online, all transactions from the duplicate account are moved to the account you’re keeping. The duplicate account is then made inactive to avoid future use. This process ensures you don’t lose any data while cleaning up your chart of accounts.

1.2. Key Considerations Before Merging

Before you start merging, keep these important points in mind:

- Irreversible Action: Merging is permanent and cannot be undone.

- Default Accounts: Some accounts connected to online banking or used as default accounts cannot be merged.

- Reconciliation Reports: Save reconciliation reports before merging, as reconciliation history might not be retained.

2. Step-by-Step Guide to Merging Accounts in QuickBooks Online

Here’s a detailed guide on How To Merge Accounts In Quickbooks Online:

2.1. Step 1: Prepare for the Merge

- Switch to Accountant View: Ensure you are in Accountant view for full access.

- Save Reconciliation Reports: If either account has reconciliation reports, save them.

- Delete Conflicting Transactions: If both accounts have opening balance equity transactions, delete the most recent one.

2.2. Step 2: Identify the Account to Keep

- Navigate to Chart of Accounts: Go to Settings ![Settings gear icon.] and select Chart of Accounts.

- Find the Primary Account: Locate the account you want to keep.

- Note Account Details: Record the Account Name, Account Type, and Detail Type.

- Check Subaccount Status: Determine if it’s a subaccount and note its parent account if applicable.

2.3. Step 3: Modify the Duplicate Account

- Return to Chart of Accounts: Go back to the Chart of Accounts.

- Find the Duplicate Account: Locate the account you want to merge into the primary account.

- Edit the Duplicate Account: In the Action column, select Edit.

- Change Account Details:

- Match the Account Name and Detail Type exactly to the primary account.

- If merging parent accounts, ensure neither has subaccounts.

- If merging subaccounts, ensure both have the same parent account.

- If only one is a subaccount, change the Account Type to match the other parent account.

2.4. Step 4: Merge the Accounts

- Save Changes: Select Save.

- Confirm Merge: Click Yes, merge accounts when prompted.

This action merges the two accounts, transferring all transactions from the duplicate to the primary account. The duplicate account is then made inactive.

3. Merging Duplicate Customers in QuickBooks Online

Merging customer profiles in QuickBooks Online involves a slightly different approach. Here’s how to do it:

3.1. Manual Deletion and Data Transfer

Unlike merging accounts, you’ll need to manually delete one of the customer profiles after transferring its data to the profile you want to keep.

3.2. Step-by-Step Instructions

- Identify the Primary Customer: Determine which customer profile you want to retain.

- Transfer Data: Manually move any necessary information from the duplicate profile to the primary profile.

- Delete the Duplicate: Delete the duplicate customer profile.

For more detailed guidance, refer to Intuit’s community resources on merging duplicate customers.

4. Merging Duplicate Vendors in QuickBooks Online

Merging duplicate vendors is similar to merging accounts, but with a few key differences:

4.1. Step-by-Step Guide

- Go to Vendors: Navigate to Expenses and select Vendors.

- Open the Primary Vendor: Find and open the vendor profile you want to keep, then select Edit.

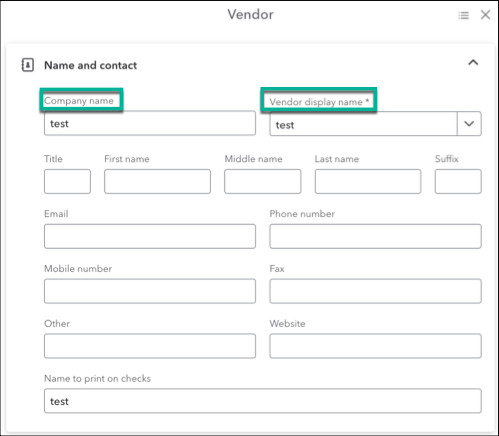

- Note Vendor Details: Record the Company name and Vendor display name.

- Open the Duplicate Vendor: Return to the Vendors tab and open the vendor profile you want to merge.

- Edit the Duplicate Vendor: Select Edit and change the display name to exactly match the primary vendor.

- Save Changes: Select Save and confirm by clicking Yes.

Vendor edit menu highlighting Company name and Vendor display name fields in QuickBooks Online

Vendor edit menu highlighting Company name and Vendor display name fields in QuickBooks Online

This action merges the two vendor profiles, moving all transactions from the duplicate to the primary vendor.

5. Best Practices for Managing Your Chart of Accounts

Maintaining a clean and organized chart of accounts is crucial for accurate financial reporting. Here are some best practices:

5.1. Regular Review

Periodically review your chart of accounts to identify and address any duplicates or unnecessary accounts.

5.2. Consistent Naming Conventions

Use consistent naming conventions to avoid creating duplicate accounts in the first place.

5.3. Use Subaccounts

Utilize subaccounts to provide more detailed categorization without cluttering your main chart of accounts.

5.4. Training and Documentation

Ensure all users are trained on proper account creation and maintenance procedures. Document these procedures for future reference.

6. How Merging Accounts Can Improve Your Online Gaming and Esports Finances

If you’re involved in online gaming or Esports, managing your finances efficiently is essential. Merging accounts in QuickBooks Online can help:

6.1. Streamlining Income Tracking

Combine income from various sources, such as streaming platforms, tournament winnings, and sponsorships, into a single account for easier tracking.

6.2. Organizing Expenses

Consolidate expenses related to gaming equipment, software, and travel into relevant accounts for better budget management.

6.3. Financial Reporting

Generate accurate financial reports to assess the profitability of your gaming activities and make informed business decisions.

7. Integrating gmonline.net for Enhanced Financial Management

gmonline.net offers resources and tools that can further enhance your financial management in the online gaming and Esports world:

7.1. Financial News and Updates

Stay informed about the latest financial trends and regulations affecting the gaming industry.

7.2. Expert Guidance

Access expert advice on managing your finances, including tax planning, budgeting, and investment strategies.

7.3. Community Support

Connect with other gamers and Esports professionals to share insights and best practices for financial management.

8. The Role of E-E-A-T and YMYL in Financial Content

When dealing with financial topics, it’s crucial to adhere to Google’s E-E-A-T (Expertise, Experience, Authoritativeness, and Trustworthiness) and YMYL (Your Money or Your Life) guidelines.

8.1. Expertise

Ensure the information provided is accurate, reliable, and based on sound financial principles.

8.2. Experience

Share practical tips and real-world examples to demonstrate the application of financial concepts.

8.3. Authoritativeness

Cite reputable sources and industry experts to support your claims and build credibility.

8.4. Trustworthiness

Be transparent about your qualifications and affiliations, and avoid making misleading or unsubstantiated statements.

9. Optimizing for Google Discovery

To ensure your content reaches a wider audience through Google Discovery, follow these optimization tips:

9.1. High-Quality Visuals

Use compelling images and videos to capture readers’ attention.

9.2. Engaging Headlines

Craft headlines that are both informative and intriguing.

9.3. Mobile-Friendly Design

Ensure your website is responsive and optimized for mobile devices.

9.4. Fast Loading Speed

Optimize your website’s loading speed to improve user experience and search rankings.

10. Leveraging SEO for Better Visibility

Implement these SEO strategies to improve your content’s visibility in search results:

10.1. Keyword Research

Identify relevant keywords and incorporate them naturally into your content.

10.2. On-Page Optimization

Optimize your title tags, meta descriptions, and header tags to improve search engine rankings.

10.3. Link Building

Build high-quality backlinks from reputable websites to increase your domain authority.

10.4. Content Freshness

Regularly update your content to keep it relevant and engaging.

11. The AIDA Model in Content Creation

The AIDA model (Attention, Interest, Desire, Action) can be used to create engaging content that drives results:

11.1. Attention

Capture readers’ attention with a compelling headline and opening paragraph.

11.2. Interest

Build interest by providing valuable information and addressing readers’ pain points.

11.3. Desire

Create desire by showcasing the benefits of merging accounts and improving financial management.

11.4. Action

Encourage readers to take action by visiting gmonline.net for more information and resources.

12. The Importance of Accurate Financial Reporting

Accurate financial reporting is essential for making informed business decisions and complying with regulatory requirements.

12.1. Tracking Performance

Monitor your income, expenses, and profitability to assess your financial performance.

12.2. Budgeting and Forecasting

Use financial data to create realistic budgets and forecasts.

12.3. Tax Compliance

Prepare accurate tax returns and comply with all applicable tax laws.

13. Tips for Creating Engaging Financial Content

Follow these tips to create engaging financial content that resonates with your audience:

13.1. Use Plain Language

Avoid jargon and technical terms that may confuse readers.

13.2. Tell Stories

Use stories and examples to illustrate financial concepts.

13.3. Be Visual

Incorporate images, videos, and infographics to break up text and engage readers.

13.4. Be Interactive

Include quizzes, polls, and calculators to encourage reader participation.

14. Financial Planning for Gamers and Esports Professionals

Financial planning is essential for gamers and Esports professionals who want to achieve long-term financial security.

14.1. Setting Goals

Define your financial goals, such as saving for retirement, buying a home, or starting a business.

14.2. Creating a Budget

Develop a budget that allocates your income to various expenses and savings goals.

14.3. Investing Wisely

Invest in a diversified portfolio of stocks, bonds, and other assets to grow your wealth over time.

15. Common Mistakes to Avoid When Managing Your Finances

Avoid these common mistakes when managing your finances:

15.1. Not Tracking Expenses

Keep track of your expenses to identify areas where you can save money.

15.2. Overspending

Avoid overspending and stick to your budget.

15.3. Not Saving

Save a portion of your income each month to build a financial cushion.

15.4. Not Investing

Invest your money wisely to grow your wealth over time.

16. The Benefits of Using QuickBooks Online

QuickBooks Online offers numerous benefits for managing your finances, including:

16.1. Cloud-Based Access

Access your financial data from anywhere with an internet connection.

16.2. Automated Tasks

Automate tasks such as invoicing, bank reconciliation, and reporting.

16.3. Integration with Other Apps

Integrate with other popular apps such as PayPal, Stripe, and Square.

16.4. Scalability

Scale your accounting system as your business grows.

17. How to Choose the Right QuickBooks Online Plan

QuickBooks Online offers various plans to suit different business needs. Consider these factors when choosing a plan:

17.1. Business Size

Choose a plan that can accommodate the number of users and transactions your business requires.

17.2. Features

Select a plan that includes the features you need, such as invoicing, expense tracking, and inventory management.

17.3. Budget

Choose a plan that fits your budget.

18. Resources for Learning More About QuickBooks Online

Numerous resources are available to help you learn more about QuickBooks Online, including:

18.1. QuickBooks Online Help Center

Access the QuickBooks Online Help Center for detailed instructions and troubleshooting tips.

18.2. QuickBooks Online Community

Join the QuickBooks Online Community to connect with other users and ask questions.

18.3. QuickBooks Online Training Courses

Enroll in a QuickBooks Online training course to learn best practices and advanced techniques.

19. Addressing Common Challenges When Merging Accounts

While merging accounts can be straightforward, you might encounter some challenges:

19.1. Dealing with Conflicting Data

Carefully review and reconcile any conflicting data before merging accounts.

19.2. Handling Subaccounts

Ensure that subaccounts are properly aligned before merging parent accounts.

19.3. Preserving Reconciliation History

Save reconciliation reports to preserve historical data.

20. Future Trends in Online Gaming and Esports Finances

The online gaming and Esports industry is constantly evolving. Stay informed about future trends in financial management:

20.1. Cryptocurrency Integration

Explore the potential of using cryptocurrencies for transactions and investments.

20.2. Blockchain Technology

Investigate the use of blockchain technology for secure and transparent financial transactions.

20.3. Artificial Intelligence

Leverage AI-powered tools for financial analysis and decision-making.

21. The Importance of Staying Updated

The financial landscape is constantly changing. Stay updated on the latest news, trends, and regulations to make informed decisions.

21.1. Subscribing to Newsletters

Subscribe to industry newsletters and blogs to stay informed.

21.2. Attending Conferences

Attend industry conferences and events to network with other professionals and learn about new developments.

21.3. Following Social Media

Follow industry experts and organizations on social media to stay up-to-date.

22. Legal and Ethical Considerations

When managing your finances, it’s essential to adhere to legal and ethical standards.

22.1. Complying with Tax Laws

Comply with all applicable tax laws and regulations.

22.2. Avoiding Fraud

Avoid any fraudulent activities, such as tax evasion or money laundering.

22.3. Maintaining Privacy

Protect the privacy of your financial information.

23. How to Get Help with QuickBooks Online

If you need help with QuickBooks Online, numerous resources are available:

23.1. QuickBooks Online Support

Contact QuickBooks Online support for assistance with technical issues and troubleshooting.

23.2. Certified QuickBooks ProAdvisors

Hire a Certified QuickBooks ProAdvisor for expert guidance and support.

23.3. Online Forums

Participate in online forums to ask questions and get advice from other users.

24. Building a Strong Financial Foundation

Building a strong financial foundation is essential for long-term success in the online gaming and Esports industry.

24.1. Setting Financial Goals

Define your financial goals and create a plan to achieve them.

24.2. Managing Your Finances

Manage your income, expenses, and investments wisely.

24.3. Seeking Professional Advice

Seek professional advice from financial advisors and accountants.

25. Call to Action: Explore gmonline.net for More Financial Resources

Ready to take your financial management to the next level? Visit gmonline.net for more resources, expert guidance, and community support. Stay informed about the latest news, find helpful tutorials, and connect with other gamers and Esports professionals. Whether you’re looking for tax planning tips, budgeting strategies, or investment advice, gmonline.net has you covered. Join our community today and start building a strong financial foundation for your online gaming and Esports career!

FAQ: Merging Accounts in QuickBooks Online

1. Can I merge accounts if they have different currencies?

No, accounts with different currencies cannot be merged in QuickBooks Online. Ensure both accounts have the same currency before attempting to merge.

2. What happens to transactions in the duplicate account after merging?

All transactions from the duplicate account are moved to the primary account. The duplicate account is then made inactive.

3. Can I merge accounts if one is connected to online banking?

No, accounts connected to online banking cannot be merged or deleted. Disconnect the account from online banking before attempting to merge.

4. How do I know if two accounts are duplicates?

Check for similar names, account types, and detail types. If they represent the same financial activity, they are likely duplicates.

5. What should I do if I accidentally merge the wrong accounts?

Unfortunately, merging accounts is permanent and cannot be undone. Review your chart of accounts carefully before merging.

6. Can I merge customer or vendor profiles if they have outstanding balances?

Yes, you can merge customer or vendor profiles with outstanding balances. The balances will be consolidated into the primary profile.

7. What happens to attachments in the duplicate account after merging?

Attachments in the duplicate account are moved to the primary account along with the transactions.

8. How often should I review my chart of accounts for duplicates?

Review your chart of accounts regularly, at least once a quarter, to identify and address any duplicates or unnecessary accounts.

9. Can I merge subaccounts with different parent accounts?

No, subaccounts must have the same parent account to be merged.

10. What if I need to split a merged account into separate accounts again?

Since merging is permanent, you cannot split a merged account. You would need to manually create new accounts and transfer the relevant transactions.