Buying auto insurance online offers a convenient and efficient way to protect yourself and your vehicle. At gmonline.net, we understand the importance of finding the right coverage at the best price. This comprehensive guide will walk you through the process, highlighting key considerations and resources to ensure you make an informed decision. Discover the ease of online car insurance shopping and secure your peace of mind with reliable coverage. We will help you learn about different types of coverage, ways to save money, and top providers in the industry for insurance policies.

Related keywords: car insurance quotes, online insurance comparison, affordable auto insurance.

1. What Is The Process Of Buying Car Insurance Online?

Buying car insurance online is simpler than you might think. It involves a few straightforward steps that can be completed from the comfort of your home.

The three primary methods for securing auto insurance are: engaging with a company representative, utilizing an independent broker, or opting for online car insurance. For help in identifying the optimal car insurance coverage, rates, and provider, you can also use a free auto quote tool like the one we provide.

Follow these steps to get car insurance online:

1.1 Get An Online Car Insurance Quote

Start by obtaining a quote from an insurer’s website or using a free car insurance quote tool like the one mentioned above. This is the first crucial step in understanding your potential costs.

To receive your quote, you’ll need to provide the following information:

- Name and address

- Driver’s license number

- Make, model, and year of your vehicle

- Vehicle identification number (VIN)

- Details of any car accidents, tickets, or insurance claims filed in the last several years

Providing accurate information ensures that your quote is as precise as possible, helping you avoid surprises later on.

1.2 Compare Quotes

Once you’ve provided the necessary information, many sites offer instant car insurance quotes. This allows you to see the cost for your selected coverage level immediately. Other companies may request your phone number or email address so an agent can contact you with your quotes and options. Be sure to reach out to several companies to thoroughly compare insurance plans and find the best fit for your needs.

Comparing multiple quotes ensures you’re getting the most competitive rate and the right coverage for your specific circumstances.

1.3 Select Coverage

Insurers that allow you to purchase a policy online will guide you through the purchase process, which should be straightforward. You’ll be asked to select the coverage you want, as well as add-on options like roadside assistance, towing, or accident forgiveness.

Take your time to understand each option and how it benefits you. Selecting the right coverage ensures you’re adequately protected in various scenarios.

1.4 Pay

Set up a payment method and input the necessary information. Most insurers may allow you to pay with a credit card, though some will charge a fee for this. Your other option is to pay through a bank by providing your routing number and account information.

Double-check your payment details to avoid any issues with your policy activation. Many insurers offer flexible payment options to suit your financial preferences.

1.5 Print Your Card

Finally, print your insurance card from home. Your insurer may also mail an I.D. card to you. Keep a copy in your car and another at home for easy access.

Having your insurance card readily available is essential for compliance and peace of mind. It ensures you can quickly provide proof of insurance when needed.

2. What To Know When Buying Car Insurance Online?

Before diving into online auto insurance, there are several key factors to consider. Understanding these will help you make an informed decision and avoid potential pitfalls.

If you’ve decided that buying auto insurance online is right for you, there are some important things to consider.

2.1 Where Can I Buy Car Insurance Online?

Most major auto insurers offer coverage online, making it easy to compare and purchase policies. Some providers that don’t offer complete online sign-ups and purchases may require you to speak to an agent before finalizing your policy. However, much of the purchase process can still be completed on the insurer’s website.

Completing the process online can take an hour or less if you’re prepared with basic information about yourself, your driving record, and your vehicle. An online car insurance policy can go into effect as soon as you make the first payment, providing immediate coverage.

2.2 Online Auto Insurance Companies

Here’s a snapshot of which major insurance providers offer car insurance online:

| Car Insurance Company | Online Car Insurance Quotes | Online Car Insurance Purchase |

|---|---|---|

| Geico | ✓ | ✓ |

| USAA | ✓ | ✓ |

| Progressive | ✓ | ✓ |

| The Hartford | ✓ | ✓ |

| Nationwide | ✓ | ✓ |

| State Farm | ✓ | |

| Liberty Mutual | ✓ | |

| AAA | ✓ | |

| Allstate | ✓ | |

| Farmers | ✓ |

This table provides a quick overview of which companies offer both online quotes and the ability to purchase a policy entirely online. Remember to research each company to find the best fit for your specific needs.

3. How Does Buying Car Insurance Work?

The online insurance purchase process is consistent across most companies. Whether you need standard or specialty coverage, understanding the options available is essential.

The online insurance purchase process is similar for most companies. If the insurer offers car insurance online, you can get any standard type of coverage you’d need right from your computer or phone. But if you’re looking for specialty auto coverages like classic car insurance, you may have to call an agent to explain your situation.

3.1 Types of Car Insurance

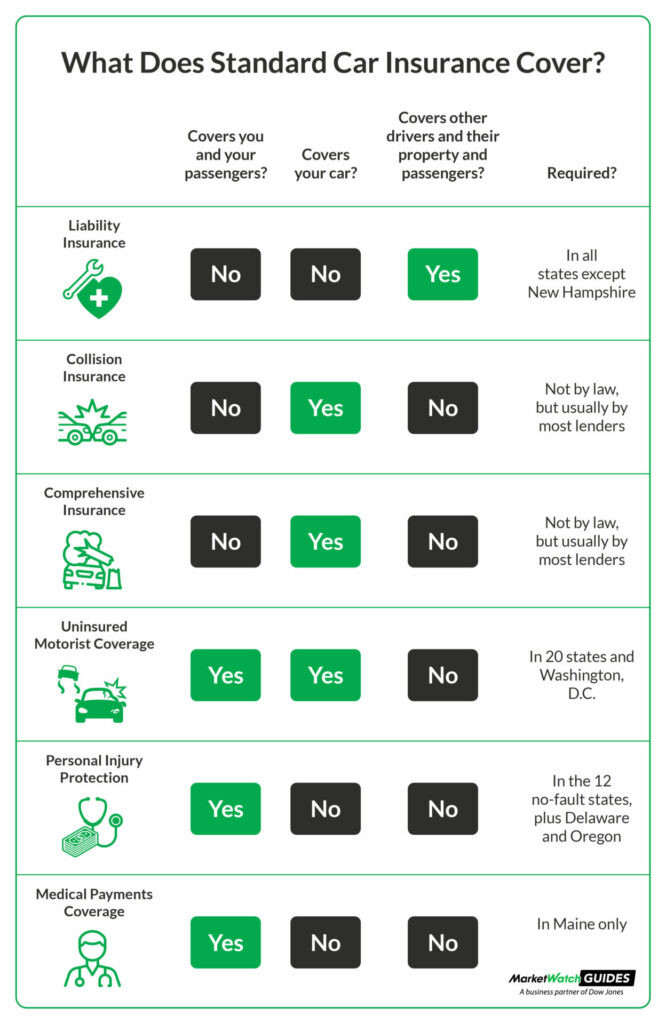

Standard types of car insurance include liability, uninsured motorist, medical expense, collision, and comprehensive coverage. Each type protects you in different situations.

A table that shows what the six standard types of car insurance do and don

A table that shows what the six standard types of car insurance do and don

3.1.1 Liability Insurance

Bodily injury and property damage liability insurance are required in most states (as of July 1, 2024, New Hampshire is the only state that doesn’t require liability coverage). If you’re found at fault for an accident, bodily injury liability will pay the medical bills of the other parties involved. Property damage will pay for repairs to the other parties’ cars. Neither type of liability coverage will pay for your own injuries or car repairs.

Liability insurance is a foundational element of any car insurance policy, protecting you from financial responsibility if you cause an accident.

3.1.2 Uninsured Motorist and Medical Expense Coverages

Uninsured/underinsured motorist coverage helps with repairs and hospital bills when someone with no insurance or insufficient insurance causes an accident. Medical expense coverages like MedPay and PIP pay for your medical expenses after an accident, with varying regulations for at-fault and no-fault states.

These coverages ensure you’re protected even when the other driver is not adequately insured.

3.1.3 Collision and Comprehensive Insurance

A full-coverage car insurance policy includes both comprehensive coverage and collision coverage. Collision insurance pays for repairs to your vehicle regardless of who caused an accident. Comprehensive coverage protects your vehicle from damages related to the environment:

- Theft

- Vandalism

- Animals

- Fallen objects

- Natural disasters like floods and fire

Collision and comprehensive coverage provide extensive protection for your vehicle against a wide range of potential damages.

Take note that auto lenders and leasing companies typically require you to carry a full-coverage policy, but comprehensive and collision coverage are not required by any U.S. state.

4. What Is The Best Way To Buy Auto Insurance?

The optimal method to buy auto insurance depends on your specific needs and understanding of insurance coverage. Purchasing online can be efficient if you know what you need, but an agent can provide valuable guidance if you’re unsure.

Below are some key differences between buying insurance online versus through an agent:

- Online: If you already know what auto insurance coverage you need, it can be a good idea to purchase car insurance online. Buying online can save time and money. Many of our recommended national providers offer online auto insurance quotes and purchasing.

- Agent: If you aren’t sure what kind of car insurance you need, you may be better off working through an agent. An agent can answer your questions and help you figure out your best coverage options.

4.1 Should I Buy Car Insurance Online?

Choosing an insurer based solely on the ability to purchase a policy entirely online is not recommended. Instead, focus on finding the company that offers the best car insurance rates and coverage for your needs. If that insurer happens to offer online car insurance quotes, it can be a convenient bonus.

It is generally cheaper to buy car insurance online, as there are no agent fees or markups. However, an agent can guide you through the purchase process and help you select the best coverage. Agents may also help you find car insurance discounts you might not otherwise know about.

Research any provider thoroughly before committing to a policy. Even if you plan to work with an insurance agent, compare quotes online first to get a sense of car insurance costs and which insurers to contact.

4.2 Car Insurance Rates Online

Full-coverage car insurance costs an average of about $199 per month or $2,386 per year for good drivers. These estimates do not include policy discounts you may qualify for, such as a homeowners discount or a discount for bundling auto with home insurance, renters insurance, or life insurance.

Other common discounts include:

- Teen driver discount

- Safe driving discount

- Good student discount

- Military discount

- Defensive driving course discount

- Safety features discounts

Explore all available discounts to lower your premium. According to research from the Entertainment Software Association (ESA), bundling policies often results in significant savings.

Keep in mind that rates change over time. Car insurance premiums can be affected by state regulations, the rate of claims in a location, population growth, and more. In a May 2024 car insurance survey, it was found that 36% of the 2,000 respondents had experienced a rate increase without an obvious cause.

4.3 Cheap Online Car Insurance Companies

Car insurance prices vary by provider. The following table shows how major providers rank based on cost for full-coverage policies:

| Car Insurance Provider | Average Monthly Cost | Average Annual Cost |

|---|---|---|

| USAA | $135 | $1,624 |

| Travelers | $161 | $1,926 |

| Geico | $165 | $1,980 |

| Auto-Owners Insurance | $167 | $1,999 |

| Erie Insurance | $168 | $2,016 |

| Nationwide | $205 | $2,459 |

| Progressive | $211 | $2,527 |

| State Farm | $220 | $2,640 |

| Allstate | $234 | $2,802 |

| Farmers | $258 | $3,099 |

*Costs are based on a standardized profile of a 35-year-old driver with good credit and a clean driving history who drives a 2023 Toyota Camry.

4.4 Online Auto Insurance Quotes

Buying coverage online usually involves getting a free car insurance quote. Quotes are based on several factors, and understanding these can help you get the best possible rate.

Car Insurance Rates Infographic

Car Insurance Rates Infographic

The cost of any auto insurance policy will depend on a number of factors, including your:

- Location: Drivers in places with higher populations and higher rates of accidents or car thefts are more risky to insure, so they’ll often pay more for auto coverage.

- Driving history: Drivers with speeding tickets, accidents, or DUIs from the past few years will pay significantly higher rates compared to drivers with clean records.

- Credit score*: Drivers with poor credit scores will pay almost double what drivers with excellent credit pay for auto insurance.

- Vehicle: Sports cars, luxury vehicles, or cars with updated technology and safety features often cost more to fix after an accident, so rates are higher for them.

- Age: Drivers under 25 (especially 16-year-olds) often pay more for car insurance because they have less experience behind the wheel.

- Marital status: Married drivers are seen by insurers as more likely to be financially stable, which means they pay less for car insurance compared to single motorists.

- Coverage selection: Adding collision and comprehensive insurance to your policy costs more but financially protects your car from collisions, theft, vandalism, and more.

- Coverage limits: Opting for minimum coverage means much lower car insurance rates, but full coverage protects a driver from paying a lot out of pocket after an accident.

- Deductible: The higher a driver’s deductible is, the cheaper their car insurance is. But this means they’ll pay more out of pocket after an accident.

*Car insurance companies in California, Hawaii, Massachusetts, and Michigan can’t use credit scores to set premiums.

4.5 Car Insurance Costs By State

Even if you purchase car insurance online, costs can vary considerably by location. Here are annual and monthly car insurance cost estimates by state for full coverage.

| State | Average Monthly Cost | Average Annual Cost |

|---|---|---|

| Alabama | $179 | $2,152 |

| Alaska | $164 | $1,962 |

| Arizona | $210 | $2,519 |

| Arkansas | $199 | $2,390 |

| California | $248 | $2,976 |

| Colorado | $237 | $2,842 |

| Connecticut | $214 | $2,571 |

| Delaware | $215 | $2,584 |

| District of Columbia | $257 | $3,084 |

| Florida | $290 | $3,485 |

| Georgia | $215 | $2,575 |

| Hawaii | $131 | $1,568 |

| Idaho | $139 | $1,663 |

| Illinois | $174 | $2,092 |

| Indiana | $157 | $1,883 |

| Iowa | $169 | $2,032 |

| Kansas | $188 | $2,252 |

| Kentucky | $217 | $2,607 |

| Louisiana | $301 | $3,611 |

| Maine | $128 | $1,537 |

| Maryland | $186 | $2,235 |

| Massachusetts | $157 | $1,879 |

| Michigan | $227 | $2,722 |

| Minnesota | $197 | $2,362 |

| Mississippi | $173 | $2,081 |

| Missouri | $210 | $2,525 |

| Montana | $205 | $2,456 |

| Nebraska | $190 | $2,283 |

| Nevada | $264 | $3,170 |

| New Hampshire | $134 | $1,604 |

| New Jersey | $232 | $2,779 |

| New Mexico | $186 | $2,236 |

| New York | $202 | $2,424 |

| North Carolina | $195 | $2,338 |

| North Dakota | $186 | $2,227 |

| Ohio | $138 | $1,661 |

| Oklahoma | $217 | $2,600 |

| Oregon | $188 | $2,257 |

| Pennsylvania | $210 | $2,524 |

| Rhode Island | $217 | $2,606 |

| South Carolina | $182 | $2,187 |

| South Dakota | $208 | $2,492 |

| Tennessee | $174 | $2,086 |

| Texas | $236 | $2,828 |

| Utah | $205 | $2,458 |

| Vermont | $122 | $1,468 |

| Virginia | $152 | $1,828 |

| Washington | $173 | $2,078 |

| West Virginia | $202 | $2,426 |

| Wisconsin | $167 | $2,009 |

| Wyoming | $140 | $1,677 |

These figures give you a broad idea of what to expect, but remember that your actual rates will depend on your individual circumstances.

5. What Are The Search Intentions For “How To Buy Auto Insurance Online?”

Understanding what people are looking for when they search for “How To Buy Auto Insurance Online” can help tailor your approach and find the right information. Here are five common search intentions:

- Step-by-step guide: Users want a detailed walkthrough of the online purchase process.

- Comparison of insurers: People seek information on which companies offer the best online experience and rates.

- Safety and security: Users are concerned about the safety of providing personal and financial information online.

- Coverage options: Individuals want to understand the different types of coverage available and which ones they need.

- Cost savings: People look for ways to find cheap or discounted auto insurance online.

6. What Are The Advantages Of Buying Auto Insurance Online?

Purchasing auto insurance online offers several compelling benefits:

- Convenience: Shop and compare policies from the comfort of your home, at any time.

- Speed: Get quotes and purchase coverage quickly, often in less than an hour.

- Transparency: Easily compare rates and coverage options from multiple insurers side-by-side.

- Cost savings: Online policies may have lower premiums due to reduced overhead costs.

- Accessibility: Access to a wide range of insurers and policy options.

7. What Are The Potential Drawbacks Of Buying Auto Insurance Online?

While online auto insurance offers numerous advantages, it’s important to be aware of potential drawbacks:

- Lack of personal advice: You may miss out on personalized guidance from an agent.

- Risk of fraud: It’s crucial to ensure you’re dealing with a legitimate insurer to avoid scams.

- Complexity: Navigating the various coverage options and terms can be confusing without assistance.

- Inaccurate quotes: Providing inaccurate information can lead to incorrect quotes and potential coverage issues.

- Limited customization: Some complex or specialty coverage needs may require speaking with an agent.

8. How Can You Ensure The Safety Of Your Information When Buying Auto Insurance Online?

Protecting your personal and financial information is paramount when buying auto insurance online. Here are some tips to ensure your safety:

- Verify the insurer’s legitimacy: Check that the company is licensed and has a good reputation.

- Look for secure websites: Ensure the website uses HTTPS and has a valid SSL certificate.

- Read reviews: Check customer reviews and ratings to gauge the company’s reliability.

- Use strong passwords: Create a unique, strong password for your insurance account.

- Be wary of phishing: Avoid clicking on suspicious links or providing information in response to unsolicited emails.

- Monitor your accounts: Regularly check your bank and credit card statements for any unauthorized activity.

9. What Should You Do After Purchasing Auto Insurance Online?

Once you’ve purchased your auto insurance policy online, take these steps to ensure everything is in order:

- Print your insurance card: Keep a copy in your car and another at home.

- Review your policy documents: Understand your coverage details, limits, and deductibles.

- Contact the insurer: Confirm that your policy is active and all information is correct.

- Set up payment reminders: Ensure you don’t miss any payments to avoid lapses in coverage.

- Update your information: Notify the insurer of any changes, such as a new address or vehicle.

- Understand the claims process: Familiarize yourself with how to file a claim in case of an accident.

10. How To Buy Car Insurance Online: FAQ

Below are some frequently asked questions about buying car insurance online:

Is it safe to buy car insurance online?

Yes, as long as you’re shopping with a legitimate insurance company, it’s safe to buy auto coverage entirely online. Many of the top auto insurers in the country allow you to buy coverage through their websites.

Who has the cheapest car insurance online?

Research shows USAA typically offers the cheapest car insurance, with rates about 32% cheaper than the national average. Drivers also tend to find cheap rates from Erie Insurance, Auto-Owners Insurance, State Farm, and Geico.

Can you get car insurance without talking to an agent?

Yes, nearly every major insurer offers a way to get quotes for car insurance online, though some require you to contact an agent before you can finalize your purchase. However, many companies allow you to complete the entire process on the internet, from quote to purchase.

Do you get the same coverage if you buy car insurance online?

You can get the same type of insurance coverage whether you buy car insurance online, call an agent, or visit a company in person. While the online quotes and purchasing process can offer convenience, some people prefer to call insurers directly or visit local agents.

11. Gmonline.net: Your Go-To Resource For Online Car Insurance

At gmonline.net, we are dedicated to providing you with the latest news, comprehensive guides, and a vibrant community to enhance your car insurance shopping experience. Whether you’re looking for breaking news, in-depth tutorials, or a place to connect with fellow car owners, gmonline.net is your ultimate destination. Stay informed, stay connected, and make the most of your car insurance journey with us.

11.1 Stay Updated

Keep up with the latest trends and developments in the car insurance industry with our dedicated news section. Our team of experienced writers and industry experts delivers timely and accurate information to keep you informed.

11.2 Comprehensive Guides

Navigate the complexities of car insurance with our easy-to-understand guides. We cover a wide range of topics, from the basics of insurance policies to advanced strategies for maximizing your coverage.

11.3 Community Engagement

Join our growing community of car owners to share your experiences, ask questions, and connect with like-minded individuals. Participate in discussions, polls, and events to enhance your knowledge and build valuable relationships.

12. Call To Action

Ready to explore the world of online auto insurance? Visit gmonline.net today to access the latest news, comprehensive guides, and a thriving community of car enthusiasts. Don’t miss out on the opportunity to stay informed, connect with others, and make the most of your car insurance experience.

For more information, contact us:

- Address: 10900 Wilshire Blvd, Los Angeles, CA 90024, United States

- Phone: +1 (310) 235-2000

- Website: gmonline.net

13. Our Methodology

Car Insurance Methodology Because consumers rely on us to provide objective and accurate information, we created a comprehensive rating system to formulate our rankings of the best car insurance companies. We collected data on dozens of auto insurance providers to grade the companies on a wide range of ranking factors. The end result was an overall rating for each provider, with the insurers that scored the most points topping the list.

Here are the factors our ratings take into account:

- Coverage (30% of total score): Companies that offer a variety of choices for insurance coverage are more likely to meet consumer needs.

- Cost and Discounts (25% of total score): Auto insurance rate estimates generated by Quadrant Information Services and discount opportunities are both taken into consideration.

- Industry Standing (20% of total score): Our research team considers market share, ratings from industry experts, and years in business when giving this score.

- Customer Experience (15% of total score): This score is based on volume of complaints reported by the National Association of Insurance Commissioners (NAIC) and customer satisfaction ratings reported by J.D. Power. We also consider the responsiveness, friendliness, and helpfulness of each insurance company’s customer service team based on our own shopper analysis.

- Availability (10% of total score): Auto insurance companies with greater state availability and few eligibility requirements score highest in this category.

Our credentials:

- 800+ hours researched

- 130+ companies reviewed

- 8,500+ consumers surveyed

*Data accurate at time of publication.

If you have feedback or questions about this article, please email our team.