Are you wondering, “Can I find my W2 online?” Absolutely! In today’s digital age, accessing your Wage and Tax Statement online is not only possible but also often the most convenient way to get your tax information. At gmonline.net, we understand the importance of having easy access to your tax documents, especially during tax season, where you’ll find the latest news, detailed guides, and a thriving community of gamers and Esports enthusiasts in the US. Let’s explore how you can securely and efficiently retrieve your W2 form online and navigate the digital tax landscape.

1. What is a W2 Form and Why Do I Need It?

A W2 form, officially known as the Wage and Tax Statement, is a crucial document that employers are required to provide to their employees each year. It reports your annual earnings and the amount of taxes withheld from your paycheck, including federal income tax, state income tax, Social Security tax, and Medicare tax.

1.1 Key Components of a W2 Form

Understanding the different boxes on your W2 form is essential for accurate tax filing. Here’s a breakdown:

| Box Number | Description |

|---|---|

| Box 1 | Total wages, tips, and other compensation |

| Box 2 | Federal income tax withheld |

| Box 3 | Social Security wages |

| Box 4 | Social Security tax withheld |

| Box 5 | Medicare wages and tips |

| Box 6 | Medicare tax withheld |

| Box 7 | Social Security tips |

| Box 8 | Allocated tips |

| Box 9 | (Left blank in 2024) |

| Box 10 | Dependent care benefits |

| Box 11 | Nonqualified deferred compensation |

| Box 12 | Various codes (see IRS instructions) |

| Box 13 | Checkboxes for specific situations |

| Box 14 | Other information |

| Box 15-20 | State and local tax information |

1.2 Why is the W2 Form Important?

The W2 form is essential for several reasons:

- Filing Your Taxes: You need your W2 form to accurately file your federal and state income tax returns. It provides the necessary information to calculate your tax liability or refund.

- Verifying Income: The W2 form serves as proof of your income for various purposes, such as applying for loans, renting an apartment, or verifying eligibility for certain government benefits.

- Tax Compliance: Employers are required to send copies of W2 forms to both employees and the IRS. This ensures that income and tax withholdings are accurately reported and tracked.

W-2 Tax Form

W-2 Tax Form

Alt text: Standard Form 436, request for duplicate wage and tax statement in PDF format.

2. Common Ways to Find Your W2 Online

There are several ways to access your W2 form online, each with its own level of convenience and security. Here are the most common methods:

2.1 Through Your Employer’s Online Portal

Many employers now offer online portals where employees can access their pay stubs, W2 forms, and other important tax documents. This is often the quickest and easiest way to retrieve your W2.

- How to Access: Log in to your employer’s payroll or HR system using your employee ID and password. Look for a section labeled “Tax Documents,” “W2 Forms,” or something similar.

- Security: Ensure that the website uses a secure (HTTPS) connection and that you are accessing the official website of your employer.

- Benefits: Instant access, secure storage, and the ability to download and print your W2 form as needed.

2.2 Through Third-Party Payroll Services

Some companies outsource their payroll processing to third-party services like ADP, Paychex, or Ceridian. If your employer uses one of these services, you may be able to access your W2 form through their online portal.

- How to Access: Visit the website of the payroll service and create an account or log in with your existing credentials. You may need to enter your employer’s information and your Social Security number to verify your identity.

- Security: These services typically have robust security measures in place to protect your sensitive information.

- Benefits: Convenient access to your W2 form, even if you no longer work for the employer.

2.3 Through the IRS Website

The IRS does not directly provide W2 forms to taxpayers. However, you can access transcripts of your tax returns, which include information from your W2 forms, through the IRS website.

- How to Access: Use the IRS’s “Get Transcript” tool online. You’ll need to verify your identity through a multi-step process.

- Security: The IRS uses advanced security measures to protect your data.

- Limitations: You will only get a transcript, not a replica of your W2.

2.4 Cal Employee Connect

If you are or were a California state employee, you can access your W2 form through Cal Employee Connect.

- How to Access: Log in to the Cal Employee Connect portal using your credentials. Navigate to the “W-2” tab to view and download your W2 form.

- Benefits: Free access to your W2 form and other important employment documents.

3. Step-by-Step Guide to Finding Your W2 Online

Let’s break down the process of finding your W2 online into a simple, step-by-step guide.

3.1 Step 1: Check Your Email

Many employers and payroll services send an email notification when your W2 form is available online. Check your inbox (including your spam folder) for any messages from your employer or a payroll service provider.

3.2 Step 2: Access Your Employer’s Online Portal

If you didn’t receive an email or prefer to go directly to the source, log in to your employer’s online portal. This is usually the same system you use to access your pay stubs and other HR information.

- Example: If you work for a large corporation, you might log in to a system like Workday or SAP SuccessFactors.

3.3 Step 3: Navigate to the Tax Documents Section

Once you’re logged in, look for a section labeled “Tax Documents,” “W2 Forms,” or something similar. The exact wording may vary depending on the system your employer uses.

3.4 Step 4: Select the Correct Tax Year

Most online portals allow you to access W2 forms from previous years as well. Make sure you select the correct tax year (e.g., 2023) for the W2 form you need.

3.5 Step 5: View, Download, or Print Your W2 Form

Once you’ve found the correct W2 form, you should be able to view it online. You may also have the option to download it as a PDF file or print it directly from your browser.

3.6 Step 6: Securely Store Your W2 Form

After you’ve downloaded or printed your W2 form, be sure to store it in a secure location. This could be a password-protected folder on your computer or a physical file cabinet in your home.

4. What to Do If You Can’t Find Your W2 Online

Sometimes, despite your best efforts, you may not be able to find your W2 form online. Here’s what to do:

4.1 Contact Your Employer’s HR or Payroll Department

Your first step should be to contact your employer’s HR or payroll department. They can help you troubleshoot any issues you’re having with the online portal or provide you with a duplicate copy of your W2 form.

- Example: “Hi HR, I’m having trouble accessing my W2 form online. Could you please assist me?”

4.2 Contact the Payroll Service Provider

If your employer uses a third-party payroll service, you can also contact them directly for assistance. They may be able to provide you with your W2 form or help you access it online.

4.3 Request a Transcript from the IRS

If you’re unable to get your W2 form from your employer or the payroll service provider, you can request a transcript from the IRS. This will give you the information you need to file your taxes, although it won’t be an exact replica of your W2 form.

4.4 File Form 4852 as a Last Resort

If you can’t get a W2 or a transcript before the tax deadline, you can file Form 4852, Substitute for Form W-2, Wage and Tax Statement. You’ll need to estimate your wages and taxes withheld based on your best recollection and any available documentation.

5. Understanding Duplicate W2 Forms and Fees

In some cases, you may need to request a duplicate copy of your W2 form. Here’s what you need to know:

5.1 Requesting a Duplicate W2 from Your Employer

Most employers are happy to provide you with a duplicate copy of your W2 form if you request it. However, some employers may charge a fee for this service.

- Example: “I need a duplicate copy of my W2 form for the 2023 tax year. Is there a fee for this?”

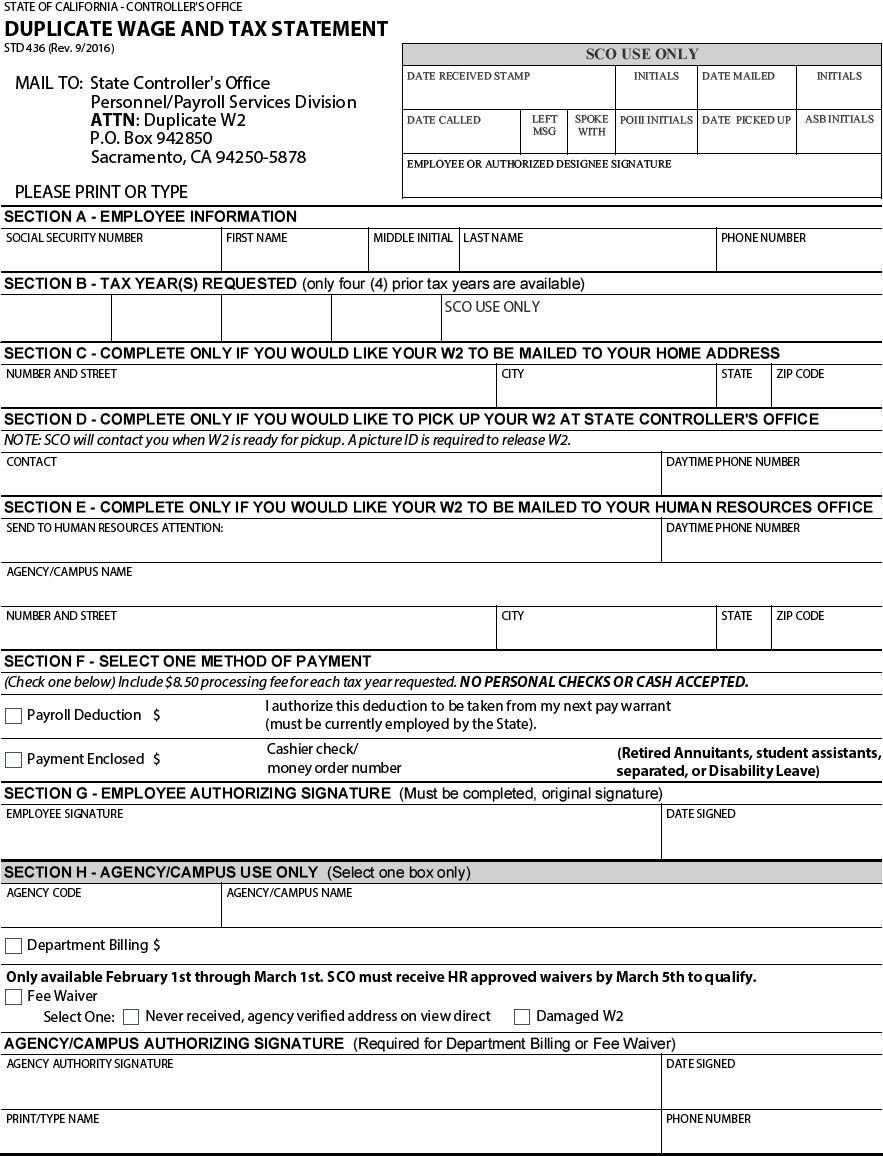

5.2 Requesting a Duplicate W2 from the State Controller’s Office (California)

If you are or were a California state employee, you can request a duplicate W2 form from the State Controller’s Office. However, there is a non-refundable processing fee of $8.50 per tax year requested.

- How to Request: Obtain a Standard Form 436: Request for Duplicate Wage and Tax Statement. You can download it as a fill and print PDF form or as a printable image.

- Payment Options: If you are currently employed with a state agency or campus, you must pay via payroll deduction. If you are no longer employed or your position does not allow for voluntary deductions, you may remit payment by cashier’s check or money order.

Alt text: Standard Form 436, a PDF document for requesting duplicate wage and tax statements from the State Controller’s Office in California.

5.3 Avoiding Fees for Duplicate W2 Forms

The best way to avoid fees for duplicate W2 forms is to access them online through your employer’s portal or Cal Employee Connect. These services typically offer free access to your W2 forms.

6. How to Read and Understand Your W2 Form

Understanding the information on your W2 form is crucial for filing your taxes accurately. Let’s take a closer look at each box and what it represents.

6.1 Box a: Employee’s Social Security Number

This box contains your Social Security number (SSN), which is used to identify you for tax purposes.

6.2 Box b: Employer’s EIN

This box contains your employer’s Employer Identification Number (EIN), which is used to identify your employer for tax purposes.

6.3 Box c: Employer’s Name and Address

This box contains your employer’s name and address.

6.4 Box d: Employee’s Name and Address

This box contains your name and address. Make sure this information is accurate, as it is used to match your W2 form to your tax return.

6.5 Box 1: Total Wages, Tips, and Other Compensation

This box shows the total amount of money you earned from your employer during the tax year, including wages, salaries, tips, bonuses, and other compensation.

6.6 Box 2: Federal Income Tax Withheld

This box shows the total amount of federal income tax that was withheld from your paycheck during the tax year. This is the amount that will be credited towards your federal income tax liability.

6.7 Box 3: Social Security Wages

This box shows the total amount of your wages that are subject to Social Security tax. This amount is capped at a certain level each year.

6.8 Box 4: Social Security Tax Withheld

This box shows the total amount of Social Security tax that was withheld from your paycheck during the tax year.

6.9 Box 5: Medicare Wages and Tips

This box shows the total amount of your wages and tips that are subject to Medicare tax.

6.10 Box 6: Medicare Tax Withheld

This box shows the total amount of Medicare tax that was withheld from your paycheck during the tax year.

6.11 Box 12: Codes

This box contains various codes that represent different types of compensation or benefits you received during the tax year. Some common codes include:

- Code D: Elective deferrals to a 401(k) plan

- Code E: Elective deferrals to a 403(b) plan

- Code DD: Cost of employer-sponsored health coverage

6.12 Box 13: Checkboxes

This box contains checkboxes that indicate whether you are a statutory employee, a participant in a retirement plan, or received third-party sick pay.

6.13 Box 14: Other Information

This box can contain a variety of other information, such as state disability insurance (SDI) contributions, union dues, or other deductions.

6.14 Boxes 15-20: State and Local Tax Information

These boxes show the amount of state and local income tax that was withheld from your paycheck during the tax year.

7. Tips for Keeping Your W2 Information Secure

Your W2 form contains sensitive information that could be used for identity theft. Here are some tips for keeping your W2 information secure:

7.1 Use Strong Passwords

When creating online accounts to access your W2 form, use strong, unique passwords that are difficult to guess. Avoid using the same password for multiple accounts.

7.2 Enable Two-Factor Authentication

If available, enable two-factor authentication (2FA) for your online accounts. This adds an extra layer of security by requiring you to enter a code from your phone or email in addition to your password.

7.3 Be Wary of Phishing Emails

Be cautious of phishing emails that ask you to provide your W2 information. These emails may look legitimate, but they are actually attempts to steal your personal information. Always verify the sender’s identity before providing any information.

7.4 Securely Store Your W2 Form

When you download or print your W2 form, store it in a secure location where it cannot be easily accessed by others. This could be a password-protected folder on your computer or a physical file cabinet in your home.

7.5 Shred Unneeded Copies

If you have any unneeded copies of your W2 form, shred them to prevent them from falling into the wrong hands.

8. How Online Gaming and Esports Professionals Can Access W2 Forms

For those in the exciting world of online gaming and Esports, accessing W2 forms is just as crucial. Here’s how it applies to this demographic:

8.1 Gamers and Streamers

Many gamers and streamers earn income through platforms like Twitch, YouTube, and Patreon. Depending on their arrangement with these platforms, they may receive a W2 form if they are classified as employees.

- Example: A streamer who is contracted by a gaming company as an employee would receive a W2 form.

8.2 Esports Athletes

Professional Esports athletes who are signed to teams or organizations typically receive a W2 form. Their earnings, including salaries, winnings, and endorsements, are reported on this form.

8.3 Game Developers and Industry Professionals

Game developers, designers, and other professionals working in the gaming industry also receive W2 forms from their employers.

8.4 Accessing W2 Forms in the Gaming World

The methods for accessing W2 forms are the same for gaming professionals as for any other employee:

- Employer’s Online Portal: Check the online portal provided by your team, organization, or company.

- Payroll Services: If the employer uses a payroll service like ADP or Paychex, access the W2 through their portal.

- Contact HR: If you can’t find it online, contact the HR or payroll department of your organization.

8.5 Tax Considerations for Gaming Professionals

Gaming and Esports professionals should be aware of the unique tax considerations that may apply to their income. This includes deducting business expenses, reporting self-employment income, and understanding tax implications for winnings and endorsements.

9. How gmonline.net Can Help You Stay Informed

At gmonline.net, we are committed to providing you with the latest news, detailed guides, and a thriving community for gamers and Esports enthusiasts in the US. Here’s how we can help you stay informed about tax-related issues and more:

9.1 Tax Tips and Guides

We offer articles and guides on tax-related topics, including information on W2 forms, deductions, and tax credits.

9.2 Gaming and Esports News

Stay up-to-date with the latest news and developments in the gaming and Esports world, including information on income opportunities and tax implications.

9.3 Community Forum

Connect with other gamers and Esports enthusiasts in our community forum to share tips, ask questions, and discuss tax-related issues.

9.4 Expert Advice

We partner with tax professionals who can provide expert advice and guidance on tax-related matters for gamers and Esports professionals.

9.5 Latest Updates and Events

Get the latest updates on new games, tournaments, and events in the gaming and Esports world, helping you stay informed and make the most of your opportunities.

Alt text: Crowd cheering at an Esports tournament, highlighting the excitement of competitive gaming.

10. Frequently Asked Questions (FAQs) About Finding Your W2 Online

Here are some frequently asked questions about finding your W2 online:

10.1 Can I Get My W2 Online?

Yes, you can typically access your W2 form online through your employer’s portal or a third-party payroll service.

10.2 How Do I Access My W2 Form Online?

Log in to your employer’s online portal or the payroll service’s website using your employee ID and password.

10.3 What If I Can’t Find My W2 Form Online?

Contact your employer’s HR or payroll department, or the payroll service provider, for assistance.

10.4 Can the IRS Provide Me With My W2 Form?

The IRS does not directly provide W2 forms, but you can request a transcript of your tax return, which includes W2 information.

10.5 Is There a Fee for Requesting a Duplicate W2 Form?

Some employers or state agencies may charge a fee for duplicate W2 forms. Check with your employer or the agency for details.

10.6 How Long Should I Keep My W2 Forms?

The IRS generally recommends keeping your tax returns and supporting documents, including W2 forms, for at least three years.

10.7 What If My W2 Form Is Incorrect?

Contact your employer immediately to request a corrected W2 form (Form W-2c).

10.8 Can I File My Taxes Without a W2 Form?

You can file Form 4852, Substitute for Form W-2, if you cannot obtain a W2 form from your employer.

10.9 How Do I Protect My W2 Information From Identity Theft?

Use strong passwords, enable two-factor authentication, be wary of phishing emails, and securely store your W2 forms.

10.10 How Can gmonline.net Help Me With Tax-Related Questions?

gmonline.net offers tax tips, guides, a community forum, and expert advice to help you stay informed about tax-related issues.

Finding your W2 form online is a convenient and efficient way to access your tax information. By following the steps outlined in this guide, you can easily retrieve your W2 form and file your taxes with confidence. And remember, for the latest news, detailed guides, and a thriving community of gamers and Esports enthusiasts in the US, visit gmonline.net at Address: 10900 Wilshire Blvd, Los Angeles, CA 90024, United States. Phone: +1 (310) 235-2000.

Ready to take control of your tax information and stay connected with the gaming community? Visit gmonline.net today to explore our resources, join our forum, and discover the latest trends in the world of online gaming and Esports!