Paying your federal taxes online has become an increasingly convenient and efficient method for taxpayers to manage their financial obligations to the IRS. The Internal Revenue Service (IRS) provides a secure and user-friendly system known as the Electronic Federal Tax Payment System (EFTPS) to facilitate these online transactions. This guide will walk you through everything you need to know about paying your federal taxes online, ensuring a smooth and timely process.

Understanding EFTPS and Enrollment

The EFTPS is a free service offered by the U.S. Department of the Treasury, allowing individuals and businesses to pay their federal taxes electronically. To utilize this service, enrollment is mandatory. The enrollment process is straightforward and can be initiated by clicking the “Enrollment” option typically found at the top of the EFTPS website.

For first-time users, the system will require validation of your information with the IRS to ensure security and accuracy. Upon successful validation, the IRS will send a Personal Identification Number (PIN) via U.S. Mail to your official IRS address of record. This PIN, which usually arrives within five to seven business days, is crucial for accessing and using the EFTPS system for tax payments.

Making Payments and Deadlines

One of the key advantages of using EFTPS is the flexibility it offers in scheduling payments. Payments can be made either through the EFTPS website or via their voice response system. However, it’s crucial to note the deadlines for timely payments. To ensure your payment is considered on time by the IRS, you must schedule it by 8 p.m. Eastern Time (ET) the day before the tax due date.

While you schedule the payment in advance, the actual funds will be debited from your designated bank account on the settlement date you specify. This allows for better financial planning and ensures payments are made promptly, avoiding potential penalties.

The EFTPS website is designed for compatibility with commonly used web browsers to ensure accessibility for all users. Supported browsers include Microsoft EDGE for Windows, Google Chrome for Windows, and Mozilla Firefox for Windows, offering a seamless experience across different platforms.

Utilizing Voice Response and Interchanging Payment Methods

For added convenience, EFTPS provides a voice response system accessible at 1.800.555.3453. This system allows taxpayers to make payments over the phone, offering an alternative to the website. Notably, you can seamlessly switch between the website and the voice response system for managing your tax payments. This interchangeability provides flexibility and ensures you can manage your payments in a way that best suits your needs at any given time.

Alternative Electronic Payment Options

While EFTPS is a primary method for online federal tax payments, alternative electronic options exist, particularly for businesses required to make electronic deposits who prefer not to use EFTPS directly. ACH Credit and same-day wire payments are viable alternatives offered through most financial institutions. To explore these options, it’s recommended to consult your bank or financial institution for details on initiating ACH Credit or same-day wire transfers for federal tax payments.

Additionally, tax professionals and payroll providers often offer services to handle federal tax payments on your behalf. If you prefer to outsource this task, consulting with a tax professional or payroll provider can be beneficial. It is important to be aware that these alternative methods, especially third-party providers, may involve fees. Furthermore, payment deadlines might be earlier when using third-party services, so it’s essential to confirm their specific deadlines to ensure timely tax payments.

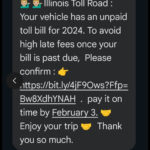

Staying Vigilant Against IRS Phishing Scams

The IRS consistently reminds taxpayers to be cautious of email scams. It’s important to understand that the IRS will only send emails through EFTPS if you have explicitly opted in for email notifications during your EFTPS enrollment. Therefore, any unsolicited email claiming to be from the IRS or an IRS-related function should be treated with suspicion.

To protect yourself from phishing attempts, the IRS advises taxpayers to report any suspicious emails to [email protected]. This helps the IRS track and combat fraudulent activities, safeguarding taxpayers from potential financial harm and identity theft.

Conclusion

Paying federal taxes online through EFTPS offers a secure, efficient, and user-friendly way to manage your tax obligations. By enrolling in EFTPS, understanding payment deadlines, and being aware of alternative payment methods, taxpayers can confidently navigate the process of online federal tax payments. Remember to stay vigilant against phishing scams and utilize the resources provided by the IRS to ensure a safe and compliant tax payment experience. Enrolling in EFTPS today can simplify your federal tax responsibilities and provide peace of mind.