Is it possible to check the PF balance online easily? Yes, checking your Provident Fund (PF) balance online is now easier than ever, ensuring you stay updated on your retirement savings and financial well-being with ease, which is why gmonline.net provides all the information you need to manage your PF account efficiently. Discover the various methods to check your PF balance, understand the importance of UAN, and learn how to navigate the EPFO portal for seamless access to your funds. Let’s dive into the detailed guide.

1. Understanding the Basics of Employee Provident Fund (EPF)

What is the Employee Provident Fund (EPF)?

The Employee Provident Fund (EPF) is a government-managed savings scheme designed to provide financial security to employees during retirement. According to research from the Ministry of Labour and Employment, in July 2023, approximately 65 million employees in India contribute to the EPF scheme. Both the employee and the employer contribute equally to this fund, which accumulates over time and earns interest. This fund can be withdrawn upon retirement, resignation, or under specific circumstances as outlined by the Employees’ Provident Fund Organisation (EPFO). The EPF is a crucial component of social security in India, ensuring that employees have a substantial financial cushion to rely on post-retirement.

Why is it important to check your EPF balance regularly?

Regularly checking your EPF balance is essential for several reasons:

- Financial Planning: Knowing your EPF balance helps you plan your future finances more effectively.

- Tracking Contributions: It ensures that your employer is making regular and accurate contributions to your account.

- Identifying Discrepancies: Regular checks can help you identify any discrepancies or errors in your account statements.

- Emergency Withdrawals: In case of emergencies, knowing your balance helps you decide how much you can withdraw.

- Retirement Planning: It allows you to estimate your retirement corpus and make necessary adjustments to your investment strategy.

Staying informed about your EPF contributions and balance provides peace of mind and empowers you to make informed financial decisions.

2. Essential Requirements Before Checking Your PF Balance Online

What is a Universal Account Number (UAN) and why is it important?

A Universal Account Number (UAN) is a unique 12-digit number assigned to each employee contributing to the EPF scheme. It acts as a single umbrella for multiple Member IDs allotted to an individual by different employers. According to the EPFO, as of June 2024, over 550 million UANs have been generated. The UAN remains constant throughout an employee’s career, regardless of job changes.

The importance of UAN lies in its ability to centralize all your EPF accounts, making it easier to manage and track your PF balance. It simplifies the process of transferring PF funds when you switch jobs and allows you to access your EPF details online through the EPFO portal.

How to activate your UAN?

Activating your UAN is a straightforward process:

- Visit the EPFO Portal: Go to the EPFO member portal.

- Click on ‘Activate UAN’: Find the ‘Activate UAN’ option under the ‘Important Links’ section.

- Enter Required Details: Provide your UAN, Aadhaar number, PAN, or Member ID.

- Verify Details: Click on ‘Get Authorization Pin’. An OTP will be sent to your registered mobile number.

- Enter OTP: Enter the OTP and click ‘Validate OTP and Activate UAN’.

Once activated, you can access your EPF passbook and other online services provided by the EPFO.

What KYC details are necessary for online PF balance check?

To check your PF balance online seamlessly, ensure that your KYC (Know Your Customer) details are updated and linked with your UAN. The necessary KYC details include:

- Aadhaar Number: Linking your Aadhaar number with your UAN is mandatory.

- PAN (Permanent Account Number): Providing your PAN ensures that your EPF contributions and withdrawals are properly accounted for under the Income Tax Act.

- Bank Account Details: Your bank account details, including account number and IFSC code, are required for processing PF withdrawals and transfers.

Updating your KYC details not only streamlines the process of checking your PF balance but also ensures compliance with EPFO regulations.

3. Checking Your PF Balance Through the EPFO Portal

Step-by-step guide to check PF balance on the EPFO portal

Checking your PF balance on the EPFO portal is a simple and convenient process. Here’s a step-by-step guide:

Step 1: Visit the EPFO Portal: Go to the official EPFO website.

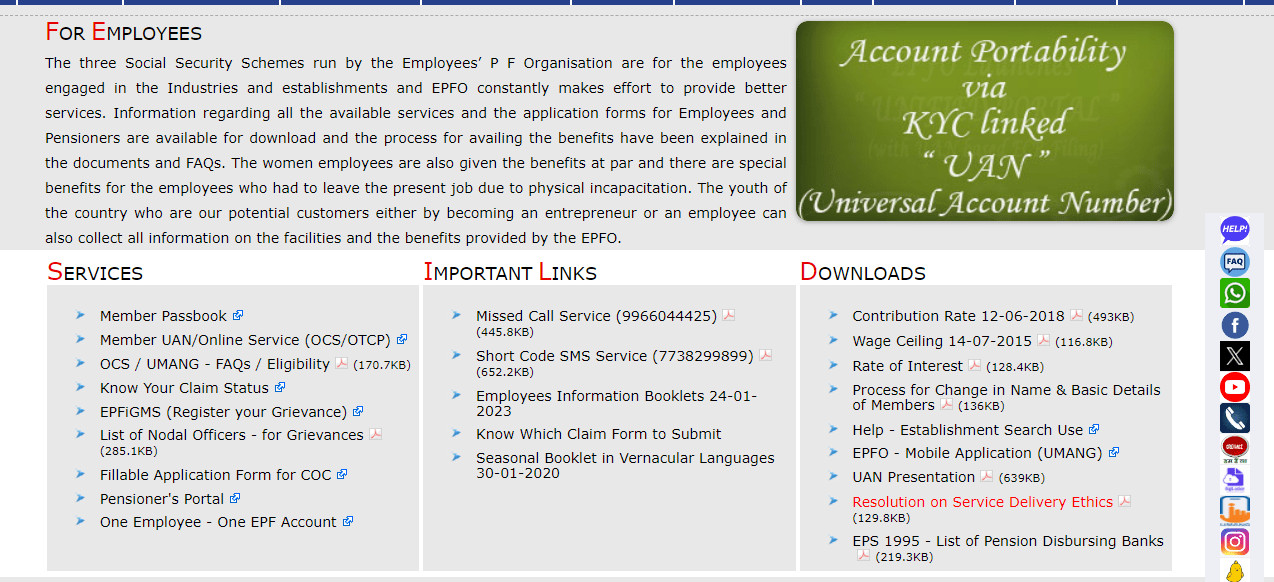

Step 2: Navigate to ‘For Employees’: Under the ‘Services’ section, click on ‘For Employees’.

Step 3: Select ‘Member Passbook’: In the ‘Services’ section, click on ‘Member Passbook’.

PF balance check

PF balance check

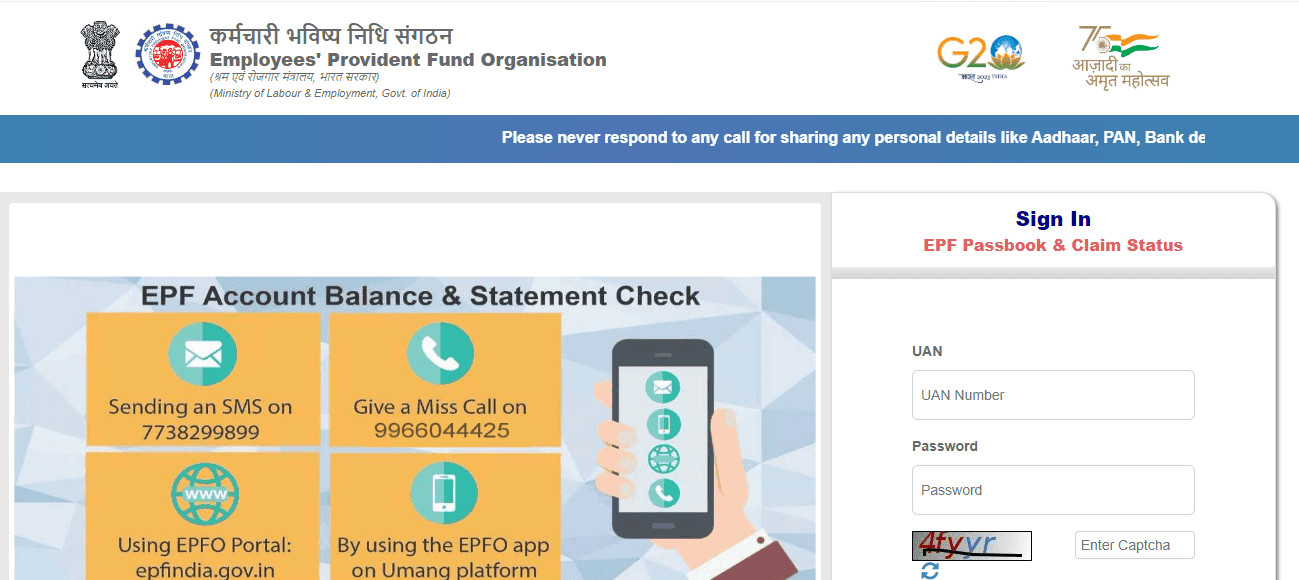

Step 4: Login with UAN and Password: Enter your UAN and password. Fill in the captcha and click on ‘Sign In’.

EPF balance check

EPF balance check

Step 5: View Passbook: Select the relevant Member ID to view your passbook and check your PF balance.

What to do if you forget your EPFO portal password?

If you forget your EPFO portal password, follow these steps to reset it:

- Visit the EPFO Portal: Go to the official EPFO website.

- Click on ‘Forgot Password’: On the login page, click on the ‘Forgot Password’ option.

- Enter UAN: Enter your UAN and click ‘Submit’.

- Verify Details: Enter the details as required (Aadhaar, Name, Date of Birth).

- OTP Verification: An OTP will be sent to your registered mobile number. Enter the OTP and click ‘Verify’.

- Set New Password: Create a new password and confirm it.

- Login: Use your UAN and new password to log in to the portal.

Common issues faced while checking PF balance on the portal and their solutions

While checking your PF balance on the EPFO portal, you may encounter some common issues. Here are a few and their solutions:

- Issue: UAN is not activated.

- Solution: Activate your UAN through the EPFO portal as described in Section 2.2.

- Issue: Incorrect password.

- Solution: Reset your password using the ‘Forgot Password’ option as described in Section 3.2.

- Issue: Portal is not loading or responding.

- Solution: This may be due to high traffic on the portal. Try again after some time or during off-peak hours.

- Issue: KYC details are not updated.

- Solution: Update your KYC details by logging into the EPFO portal and providing the necessary information (Aadhaar, PAN, Bank Account Details).

4. Using the UMANG App to Check Your PF Balance

How to download and register on the UMANG app?

The UMANG (Unified Mobile Application for New-age Governance) app is a government platform that provides access to various government services, including EPFO. Here’s how to download and register:

- Download the App: Download the UMANG app from the Google Play Store or Apple App Store.

- Install the App: Install the app on your smartphone.

- Open the App: Open the UMANG app and select your preferred language.

- Register/Login: If you are a new user, click on ‘Register’. Enter your mobile number and verify it with an OTP. Create a password. If you are an existing user, simply log in with your mobile number and password.

Step-by-step guide to check PF balance using the UMANG app

Checking your PF balance using the UMANG app is convenient and easy. Follow these steps:

Step 1: Login to the UMANG App: Open the UMANG app and log in using your registered mobile number and password.

Step 2: Select ‘EPFO’: In the app’s service directory, search for ‘EPFO’ and select it.

Step 3: Choose ‘Employee Centric Services’: Under EPFO services, click on ‘Employee Centric Services’.

Step 4: Click on ‘View Passbook’: Select ‘View Passbook’ from the options.

Step 5: Enter UAN and OTP: Enter your UAN and click on ‘Get OTP’. An OTP will be sent to your registered mobile number. Enter the OTP and click ‘Submit’.

Step 6: View Passbook: Select the Member ID to view your PF passbook and check your balance.

Benefits of using the UMANG app for PF-related services

Using the UMANG app for PF-related services offers several benefits:

- Convenience: Access your PF details anytime, anywhere, directly from your smartphone.

- Comprehensive Services: In addition to checking your balance, you can also raise claims, track their status, and access other EPFO services.

- User-Friendly Interface: The app has a simple and intuitive interface, making it easy for anyone to use.

- Secure Access: The app uses secure authentication methods, such as OTP verification, to protect your data.

- Integration: The UMANG app integrates various government services into a single platform, providing a seamless experience.

5. Checking Your PF Balance Via SMS

How to check PF balance via SMS: Step-by-step guide

Checking your PF balance via SMS is a quick and easy method, provided your UAN is activated and linked with your KYC details. Here’s how to do it:

Step 1: Compose an SMS: Open your mobile messaging app.

Step 2: Type the SMS: Type the following message: EPFOHO UAN <Language Code>. Replace <Language Code> with the first three letters of your preferred language (e.g., ENG for English, HIN for Hindi).

Step 3: Send the SMS: Send the SMS to 7738299899.

Step 4: Receive Details: You will receive an SMS with your PF details, including your current balance.

What are the prerequisites for checking PF balance via SMS?

Before checking your PF balance via SMS, ensure that you meet the following prerequisites:

- UAN Activation: Your UAN must be activated.

- KYC Compliance: Your UAN must be linked with your KYC details, including Aadhaar, PAN, and bank account.

- Registered Mobile Number: The SMS must be sent from your mobile number registered with the EPFO.

Available languages for receiving PF balance information via SMS

The SMS service is available in multiple languages, making it accessible to a wider audience. The available languages and their codes are:

- English (ENG)

- Hindi (HIN)

- Punjabi (PUN)

- Gujarati (GUJ)

- Marathi (MAR)

- Kannada (KAN)

- Telugu (TEL)

- Tamil (TAM)

- Malayalam (MAL)

- Bengali (BEN)

6. Checking Your PF Balance Via Missed Call

How to check PF balance via a missed call: Step-by-step guide

Checking your PF balance via a missed call is another convenient method, provided you meet the necessary requirements. Here’s how to do it:

Step 1: Dial the Number: Dial 9966044425 from your registered mobile number.

Step 2: Disconnect the Call: The call will automatically disconnect after a few rings.

Step 3: Receive SMS: You will receive an SMS with your PF details, including your current balance.

What are the prerequisites for checking PF balance via a missed call?

Before checking your PF balance via a missed call, ensure that you meet the following prerequisites:

- UAN Activation: Your UAN must be activated.

- KYC Compliance: Your UAN must be linked with your KYC details, including Aadhaar, PAN, and bank account.

- Registered Mobile Number: The missed call must be made from your mobile number registered with the EPFO.

Advantages and limitations of using the missed call service

The missed call service offers several advantages:

- Convenience: It’s a quick and hassle-free way to check your PF balance.

- No Charges: The service is free of charge.

- Accessibility: It can be used by anyone with a registered mobile number.

However, it also has some limitations:

- KYC Requirement: It requires your UAN to be linked with your KYC details.

- Registered Mobile Number: It can only be used from your registered mobile number.

7. Checking PF Balance Without UAN

Is it possible to check PF balance without UAN?

Checking your PF balance without a UAN is generally not possible through online methods. The UAN acts as a central identifier for your EPF accounts, and most online services require it for authentication.

Alternative methods to check PF balance if you don’t have a UAN

If you do not have a UAN, you can still check your PF balance through the following alternative methods:

- Contact Your Employer: Your employer can provide you with your PF balance details.

- Visit the EPFO Office: You can visit the nearest EPFO office and request your balance details.

- Check Your Salary Slip: Your salary slip may contain details of your PF contributions and balance.

Steps to generate or retrieve your UAN

If you do not have a UAN, you can generate or retrieve it through the following steps:

- Visit the EPFO Portal: Go to the official EPFO website.

- Navigate to ‘Know Your UAN Status’: Under the ‘Services’ section, click on ‘Know Your UAN Status’.

- Enter Required Details: Provide your Aadhaar number, PAN, or Member ID.

- Verify Details: Click on ‘Get Authorization Pin’. An OTP will be sent to your registered mobile number.

- Enter OTP: Enter the OTP and click ‘Validate OTP and Activate UAN’.

Once you retrieve your UAN, you can use it to access your PF details online.

8. EPF Balance Check for Exempted Establishments

What are exempted establishments and how do they differ?

Exempted establishments are companies that have been granted an exemption from the EPFO scheme. These establishments manage their own PF trusts, which are responsible for managing the PF contributions of their employees. They differ from establishments covered under the EPFO scheme, where the EPFO manages the PF contributions.

How to check EPF balance if you work for an exempted establishment

If you work for an exempted establishment, you cannot check your EPF balance through the EPFO portal or the UMANG app. Instead, you need to check your balance through the following methods:

- Check Your Salary Slip: Your salary slip may contain details of your PF contributions and balance.

- Contact Your Employer: Your employer or the trust managing the PF can provide you with your balance details.

- Company’s Employee Portal: Many exempted establishments have their own employee portals where you can access your PF details.

Contacting the trust or HR department for balance information

To get your EPF balance information, you can contact the trust managing the PF or your company’s HR department. They can provide you with your balance statement and answer any queries you may have regarding your PF account.

9. Understanding Your EPF Passbook

What information is included in your EPF passbook?

Your EPF passbook contains detailed information about your PF account, including:

- Employee Contributions: The amount you have contributed to your PF account.

- Employer Contributions: The amount your employer has contributed to your PF account.

- Interest Earned: The interest earned on your PF balance.

- Withdrawals: Any withdrawals you have made from your PF account.

- Transfers: Any transfers of PF funds from previous employers.

- Total Balance: The total balance in your PF account.

How to download your EPF passbook from the EPFO portal or UMANG app

You can download your EPF passbook from the EPFO portal or the UMANG app by following the steps outlined in Sections 3.1 and 4.2, respectively.

How to interpret the entries and details in your EPF passbook

Interpreting the entries and details in your EPF passbook is essential for understanding your PF account. Here are some key points to consider:

- Employee and Employer Contributions: Check that the contributions are being made regularly and accurately.

- Interest Calculation: Verify that the interest is being calculated correctly based on the prevailing interest rate.

- Withdrawals and Transfers: Ensure that any withdrawals or transfers are properly recorded and accounted for.

- Balance Reconciliation: Reconcile the closing balance with your own records to ensure accuracy.

10. Common Queries and FAQs About Checking PF Balance Online

What to do if there is a discrepancy in your PF balance?

If you find a discrepancy in your PF balance, take the following steps:

- Contact Your Employer: Inform your employer about the discrepancy and provide them with the details.

- Contact the EPFO: If your employer is unable to resolve the issue, contact the EPFO and file a complaint.

- Provide Documentation: Provide any relevant documentation, such as your salary slips and EPF passbook, to support your claim.

How often should you check your PF balance?

It is recommended to check your PF balance at least once a month to ensure that contributions are being made regularly and accurately. Regular checks can also help you identify any discrepancies or errors in your account statements.

Can you check your PF balance on weekends or holidays?

Yes, you can check your PF balance on weekends or holidays through the online methods, such as the EPFO portal and the UMANG app, as these services are available 24/7.

Is it safe to check PF balance online? What security measures are in place?

Yes, it is generally safe to check your PF balance online, provided you use the official EPFO portal or the UMANG app. The EPFO has implemented various security measures to protect your data, including:

- Encryption: All data transmitted between your computer and the EPFO server is encrypted.

- Secure Authentication: The EPFO uses secure authentication methods, such as UAN and OTP verification, to verify your identity.

- Firewalls: The EPFO has firewalls in place to prevent unauthorized access to its servers.

- Regular Audits: The EPFO conducts regular security audits to identify and address any vulnerabilities.

However, it is important to take some precautions on your end, such as using a strong password and keeping your UAN and other personal details confidential.

11. Maximizing Your EPF Benefits

Strategies to increase your EPF contributions

To maximize your EPF benefits, consider the following strategies:

- Voluntary Contributions: Increase your voluntary contributions to the EPF scheme to build a larger retirement corpus.

- Avoid Premature Withdrawals: Avoid making premature withdrawals from your EPF account, as this can reduce your retirement savings.

- Transfer PF Funds: When you switch jobs, transfer your PF funds from your previous employer to your current employer to keep your retirement savings intact.

Understanding EPF interest rates and how they are calculated

The EPF interest rate is determined by the EPFO and is subject to change. The interest is calculated on the monthly running balance in your PF account and is credited to your account at the end of each financial year. As of 2023-2024, the EPF interest rate is 8.15% per annum.

Tax benefits of investing in EPF

Investing in EPF offers several tax benefits:

- Deduction under Section 80C: Contributions to EPF are eligible for deduction under Section 80C of the Income Tax Act, up to a maximum of INR 1.5 lakhs per financial year.

- Tax-Free Interest: The interest earned on your EPF balance is tax-free.

- Tax-Free Withdrawals: Withdrawals from your EPF account are tax-free, provided you meet certain conditions.

12. Staying Updated with EPFO News and Updates

How to stay informed about the latest EPFO circulars and announcements

Staying informed about the latest EPFO circulars and announcements is essential for keeping up with changes in regulations and policies. You can stay updated through the following methods:

- Visit the EPFO Website: Regularly visit the official EPFO website.

- Follow EPFO on Social Media: Follow the EPFO on social media platforms like Twitter and Facebook.

- Subscribe to Newsletters: Subscribe to EPFO newsletters to receive updates via email.

- Read News Articles: Read news articles and financial publications to stay informed about EPFO developments.

Impact of recent policy changes on EPF balance check and withdrawals

Recent policy changes can have a significant impact on EPF balance check and withdrawals. For example, changes in interest rates can affect the growth of your PF balance, while changes in withdrawal rules can affect your ability to access your funds.

Resources for resolving grievances related to EPF

If you have any grievances related to EPF, you can resolve them through the following resources:

- EPFO Grievance Redressal Portal: File a complaint on the EPFO Grievance Redressal Portal.

- EPFO Helpline: Contact the EPFO helpline for assistance.

- EPFO Office: Visit the nearest EPFO office and speak to a representative.

13. Real-Life Examples and Case Studies

Case study 1: How an employee efficiently tracked and managed their PF balance using the EPFO portal

Background: John, a 35-year-old IT professional, had been working for various companies over the past decade. He found it challenging to keep track of his PF accounts with different employers.

Challenge: John needed a way to consolidate and manage his PF accounts efficiently.

Solution: John activated his UAN and linked all his previous Member IDs to it. He then started using the EPFO portal to check his PF balance regularly.

Outcome: John was able to track his PF balance accurately and ensure that his employer was making regular contributions. He also used the portal to transfer his PF funds from previous employers to his current account.

Case study 2: Using the UMANG app to quickly access PF details during an emergency

Background: Priya, a 28-year-old teacher, faced a medical emergency and needed funds urgently.

Challenge: Priya needed to access her PF balance quickly to determine how much she could withdraw.

Solution: Priya used the UMANG app on her smartphone to check her PF balance. She was able to log in and view her passbook in a matter of minutes.

Outcome: Priya quickly assessed her PF balance and initiated a withdrawal request through the app. She received the funds in her account within a few days, which helped her cover the medical expenses.

Case study 3: Resolving a discrepancy in PF contributions through EPFO’s grievance redressal mechanism

Background: Rajesh, a 42-year-old engineer, noticed a discrepancy in his PF contributions. His employer had not made contributions for a few months.

Challenge: Rajesh needed to resolve the discrepancy and ensure that his employer made the pending contributions.

Solution: Rajesh filed a complaint on the EPFO Grievance Redressal Portal. He provided documentation, such as his salary slips and EPF passbook, to support his claim.

Outcome: The EPFO investigated the matter and directed Rajesh’s employer to make the pending contributions. Rajesh was able to resolve the issue and ensure that his PF account was up to date.

14. Tips for Maintaining a Healthy EPF Account

Regularly update your KYC details

Keep your KYC details updated to ensure smooth access to your PF account and avoid any issues with withdrawals or transfers.

Monitor your EPF account statements

Regularly monitor your EPF account statements to check for any discrepancies or errors.

Keep your UAN and password secure

Keep your UAN and password confidential to prevent unauthorized access to your PF account.

Nominate a beneficiary for your EPF account

Nominate a beneficiary for your EPF account to ensure that your funds are distributed according to your wishes in the event of your death.

15. Future Trends in EPF Management

Potential advancements in online PF balance check methods

Potential advancements in online PF balance check methods include:

- AI-Powered Chatbots: AI-powered chatbots that can answer your queries and provide assistance with your PF account.

- Blockchain Technology: Blockchain technology to enhance the security and transparency of EPF transactions.

- Integration with Digital Wallets: Integration with digital wallets to make it easier to manage and access your PF funds.

The role of technology in simplifying EPF management

Technology will play a crucial role in simplifying EPF management in the future. Online portals, mobile apps, and AI-powered tools will make it easier for employees to track their PF balance, make withdrawals, and manage their accounts.

Government initiatives to improve EPF services

The government is continuously taking initiatives to improve EPF services. These initiatives include:

- Digitization of Records: Digitizing all EPF records to make them more accessible and transparent.

- Online Grievance Redressal: Providing an online grievance redressal mechanism to resolve complaints quickly and efficiently.

- Awareness Campaigns: Conducting awareness campaigns to educate employees about their EPF rights and responsibilities.

16. Conclusion: The Importance of Staying Proactive with Your EPF Account

Staying proactive with your EPF account is essential for securing your financial future. Regularly checking your PF balance, updating your KYC details, and monitoring your account statements can help you maximize your EPF benefits and ensure a comfortable retirement.

Ready to take control of your financial future? Visit gmonline.net today for more information and resources on managing your EPF account and securing your retirement! Stay informed, stay proactive, and make the most of your EPF benefits.

17. FAQs About Checking PF Balance Online

1. How do I check my PF balance online?

You can check your PF balance online through the EPFO portal, UMANG app, via SMS, or by giving a missed call to the EPFO-provided number. Make sure your UAN is activated and linked with your KYC details.

2. What is UAN and why is it needed to check PF balance online?

UAN stands for Universal Account Number. It’s a unique identifier for each employee contributing to the EPF scheme. It’s necessary to check your PF balance online because it centralizes all your PF accounts, making it easier to manage and track your PF balance.

3. How can I activate my UAN?

To activate your UAN, visit the EPFO member portal, click on ‘Activate UAN’ under ‘Important Links’, enter your details, verify with OTP, and validate.

4. What KYC details are required to check PF balance online?

The necessary KYC details include your Aadhaar number, PAN (Permanent Account Number), and bank account details.

5. What should I do if I forget my EPFO portal password?

If you forget your EPFO portal password, click on ‘Forgot Password’ on the login page, enter your UAN, verify your details, and set a new password.

6. How can I check my PF balance using the UMANG app?

Download the UMANG app, log in, select EPFO, choose ‘Employee Centric Services’, click on ‘View Passbook’, enter your UAN and OTP, and submit to view your PF passbook.

7. How do I check my PF balance via SMS?

Send an SMS in the format EPFOHO UAN <Language Code> to 7738299899. Replace <Language Code> with the first three letters of your preferred language.

8. What are the prerequisites for checking PF balance via SMS or missed call?

Your UAN must be activated, linked with your KYC details, and the SMS/missed call must be sent from your registered mobile number.

9. Can I check my PF balance without a UAN?

Checking your PF balance without a UAN is generally not possible through online methods. Contact your employer or visit the EPFO office for alternative methods.

10. What should I do if there is a discrepancy in my PF balance?

Contact your employer and the EPFO, and provide relevant documentation like your salary slips and EPF passbook to support your claim.

Address: 10900 Wilshire Blvd, Los Angeles, CA 90024, United States. Phone: +1 (310) 235-2000. For more information, visit gmonline.net.