Getting a copy of your W2 form online is easier than you might think, especially if you’re navigating the world of online gaming and esports with gmonline.net. This guide will provide you with all the necessary steps and resources to obtain your W2 form efficiently, ensuring you’re ready for tax season while keeping up with the latest gaming news and strategies.

1. Understanding the W2 Form: Your Key to Tax Season

The W2 form, officially known as the Wage and Tax Statement, is a crucial document you receive from your employer each year. It reports your annual earnings and the total taxes withheld from your paycheck. Understanding its contents is essential for filing your tax return accurately.

What Information Does the W2 Form Include?

Your W2 form contains a wealth of information that’s vital for tax preparation. Key details include:

- Your Employer’s Information: Name, address, and Employer Identification Number (EIN).

- Your Information: Name, address, and Social Security Number (SSN).

- Wages, Tips, and Other Compensation: Total taxable income you received during the year (Box 1).

- Federal Income Tax Withheld: The amount of federal income tax withheld from your pay (Box 2).

- State Income Tax Information: Includes the amount of state income tax withheld, your state’s identification number, and the state wages (Boxes 16, 17, and 15 respectively).

- Local Income Tax Information: Similar to state tax information, but for local taxes (Boxes 18, 19, and 20).

- Social Security and Medicare Taxes: The amounts withheld for Social Security and Medicare taxes (Boxes 4 and 6).

- Other Information: Includes contributions to retirement plans, health insurance premiums, and other benefits (Boxes 12-14).

Understanding these details ensures you can accurately file your tax return and claim any eligible deductions or credits.

Why is the W2 Form Important?

The W2 form is important for several key reasons:

- Filing Your Tax Return: It provides the necessary information to accurately report your income and taxes withheld to the IRS.

- Claiming Tax Refunds: Ensures you receive any tax refunds you’re entitled to by accurately reporting your tax withholdings.

- Verifying Income: Used as proof of income for various purposes, such as loan applications or renting an apartment.

- Avoiding Penalties: Filing your tax return accurately and on time helps you avoid penalties from the IRS.

Missing or misreporting information from your W2 can lead to delays in processing your tax return or even audits. Therefore, it’s important to handle your W2 form carefully and ensure all information is accurate.

Common Mistakes to Avoid When Using Your W2 Form

To ensure a smooth tax filing process, avoid these common mistakes when using your W2 form:

- Incorrect Social Security Number: Double-check that your SSN is accurate, as this is a common error that can cause issues with your tax return.

- Misreporting Income: Ensure you accurately report your wages, tips, and other compensation as listed on your W2.

- Ignoring Box 12 Codes: Box 12 contains codes that represent various deductions and contributions, such as retirement contributions. Make sure to understand and properly report these codes.

- Using an Old or Incorrect Address: Ensure the address on your W2 is current, as this is where the IRS will send any correspondence or refunds.

- Filing Late: File your tax return on time to avoid penalties. The deadline is typically April 15th, but it’s always a good idea to confirm the exact date each year.

- Not Keeping a Copy: Always keep a copy of your W2 form for your records. This can be helpful if you need to amend your tax return or provide proof of income in the future.

Avoiding these mistakes will help you file your tax return accurately and efficiently, ensuring you receive any refunds you’re entitled to and avoid penalties from the IRS.

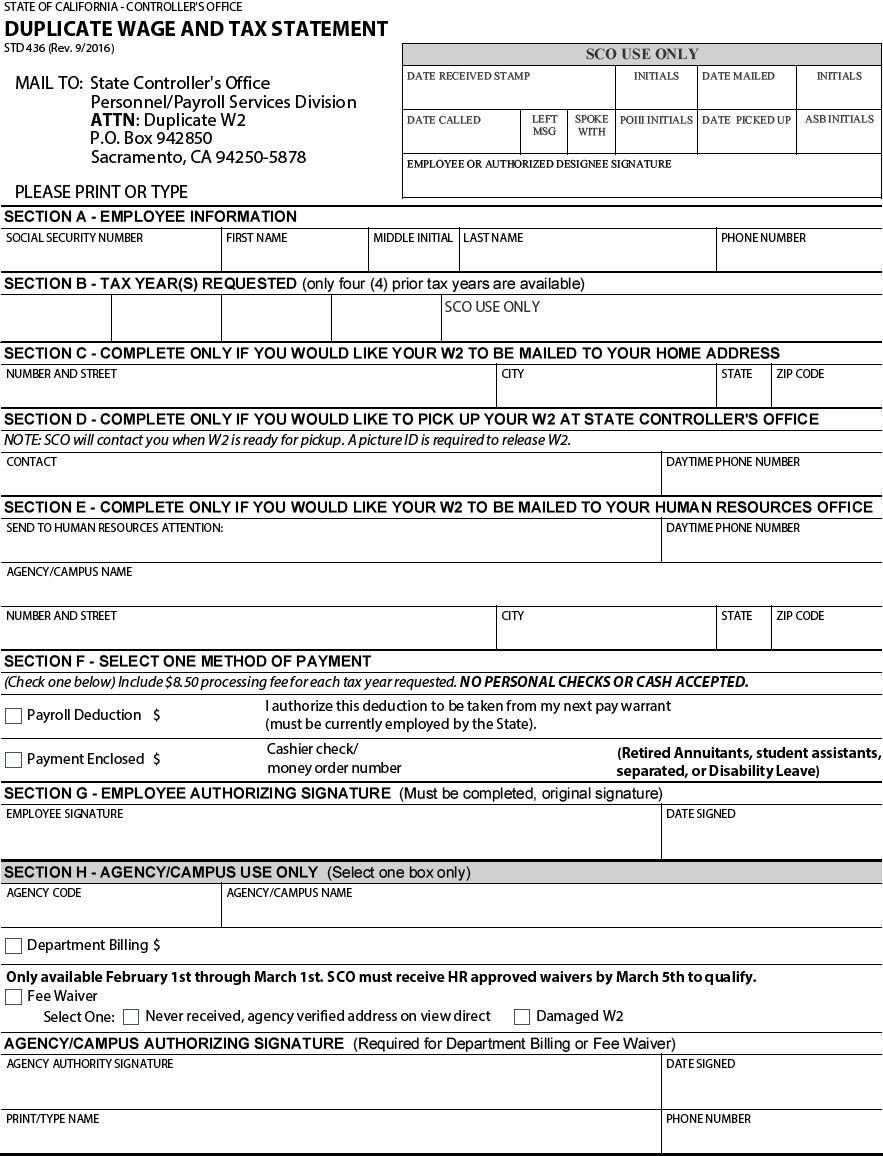

W-2 form example

W-2 form example

2. How to Access Your W2 Form Online: Step-by-Step Guide

Accessing your W2 form online is a convenient and efficient way to manage your tax information. Here’s a detailed guide to help you through the process.

Check Your Employer’s Online Portal

Many employers now offer online portals where you can access your W2 form electronically. Here’s how to check:

- Log In: Access your employer’s payroll or HR system through their website.

- Navigate: Look for a section labeled “Payroll,” “Tax Documents,” or something similar.

- Find Your W2: Select the appropriate tax year and download your W2 form.

If you encounter any issues, contact your HR department for assistance. This method is particularly useful for staying organized and reducing paper clutter.

Use Your Payroll Provider’s Website

Many companies use third-party payroll providers like ADP, Paychex, or Intuit. These providers often offer online access to your W2 forms.

- Create an Account: If you haven’t already, create an account on the payroll provider’s website.

- Verify Your Identity: You may need to verify your identity using information from a previous pay stub or tax return.

- Access Your W2: Once logged in, navigate to the tax forms section and download your W2.

Using your payroll provider’s website is a secure way to access your tax documents and ensure you have the information you need for filing your taxes.

Accessing W2 Through Cal Employee Connect

For California state employees, Cal Employee Connect is a valuable resource for accessing your W2 form online. Here’s how to use it:

- Visit the Website: Go to the Cal Employee Connect website.

- Log In: Use your existing account credentials to log in. If you don’t have an account, you’ll need to register.

- Navigate to the W2 Tab: Once logged in, look for the “W2” tab.

- Download Your Form: Select the relevant tax year and download your W2 form.

Cal Employee Connect provides a convenient and secure way for California state employees to access their W2 forms and other important payroll information. This ensures you have all the necessary documents for tax season.

Requesting a Copy from the IRS

If you cannot obtain your W2 from your employer or payroll provider, you can request a copy from the IRS. Here’s how:

- Complete Form 4506-T: Fill out IRS Form 4506-T, Request for Transcript of Tax Return.

- Submit the Form: Mail the completed form to the IRS address listed on the form instructions.

- Receive Your Transcript: The IRS will mail you a tax return transcript, which includes the information from your W2.

Requesting a copy from the IRS should be a last resort, as it can take several weeks to receive the transcript. However, it’s a reliable way to obtain your tax information if other methods are not successful.

Contacting Your Previous Employers

If you need a W2 from a previous employer, start by contacting them directly.

- Find Contact Information: Look up the company’s contact information online or through previous pay stubs.

- Contact HR or Payroll: Reach out to the HR or payroll department and request a copy of your W2 form.

- Provide Necessary Information: Be prepared to provide your name, Social Security number, and the years you worked for the company.

Contacting your previous employers is often the quickest way to obtain your W2 form. Most employers are happy to provide this information to ensure you can file your taxes accurately.

3. What to Do If You Don’t Receive Your W2 Form

It can be stressful if you don’t receive your W2 form by the end of January. Here’s what steps you should take to resolve the issue.

Contact Your Employer First

The first step should always be to contact your employer’s HR or payroll department.

- Inquire About the Delay: Ask if the W2 has been mailed and confirm the mailing address they have on file.

- Request a Duplicate Copy: If the W2 has not been mailed, request a duplicate copy to be sent to you or made available online.

- Follow Up: If you don’t receive a response or resolution within a few days, follow up with another email or phone call.

Most employers are responsive and can quickly resolve the issue, ensuring you receive your W2 form in a timely manner.

Contact the IRS

If you don’t receive your W2 form and your employer is unresponsive, you can contact the IRS for assistance.

- Call the IRS: Call the IRS at 1-800-829-1040.

- Provide Information: Be prepared to provide your name, address, Social Security number, employer’s name, and the dates you worked for the employer.

- File Form 4852: The IRS may instruct you to file Form 4852, Substitute for Form W-2, Wage and Tax Statement.

Filing Form 4852 allows you to estimate your income and taxes withheld, enabling you to file your tax return even without the actual W2 form.

File Form 4852: Substitute for Form W-2

If you haven’t received your W2 by the tax filing deadline, you can file Form 4852 with the IRS.

- Download the Form: Obtain Form 4852 from the IRS website.

- Fill Out the Form: Provide as much information as possible, including your employer’s name, address, and your best estimate of your wages and taxes withheld.

- Attach Explanation: Include a statement explaining why you did not receive your W2 and the steps you took to obtain it.

- File with Your Tax Return: Submit Form 4852 along with your tax return.

Filing Form 4852 allows you to meet the tax filing deadline and avoid penalties, even if you haven’t received your W2 form. Be sure to keep a copy of the form and any supporting documentation for your records.

Amending Your Tax Return

If you receive your W2 after filing Form 4852, you may need to amend your tax return.

- File Form 1040-X: Use Form 1040-X, Amended U.S. Individual Income Tax Return, to correct any errors on your original tax return.

- Include Corrected Information: Provide the correct income and tax information from your W2 form.

- Submit the Amended Return: Mail the amended return to the IRS address listed on the form instructions.

Amending your tax return ensures that your tax records are accurate and that you receive any additional refund you may be entitled to. Be sure to keep copies of all amended returns and supporting documentation for your records.

Avoiding Future Issues

To prevent similar issues in the future, take these steps:

- Keep Your Contact Information Updated: Ensure your employer has your current address and contact information.

- Opt for Electronic Delivery: If available, choose to receive your W2 form electronically.

- Check Regularly: Monitor your employer’s online portal or payroll provider’s website for your W2 form.

- Maintain Records: Keep copies of your pay stubs and tax returns for your records.

By taking these proactive steps, you can minimize the chances of encountering issues with your W2 form in the future and ensure a smoother tax filing process.

4. Understanding Duplicate W2 Forms and Fees

Requesting a duplicate W2 form might involve fees, depending on the employer and the method of retrieval. Understanding these costs and options can save you time and money.

When Do You Need a Duplicate W2?

You might need a duplicate W2 form in several situations:

- Lost or Misplaced Form: If you lose your original W2 form, you’ll need a duplicate to file your taxes.

- Incorrect Information: If the information on your W2 is incorrect, you’ll need a corrected form (W2-C) from your employer.

- Identity Theft: If you suspect identity theft, you may need a duplicate W2 to verify your income and tax information.

- Multiple Jobs: If you have multiple jobs, you’ll need a W2 form from each employer to file your taxes accurately.

Knowing when you need a duplicate W2 form ensures you can take the necessary steps to obtain it and file your taxes on time.

Fees for Duplicate W2 Forms

Some employers may charge a fee for providing duplicate W2 forms. Here’s what you need to know:

- Employer Policies: Check your employer’s policy on duplicate W2 forms, as fees can vary.

- State Regulations: Some states have regulations regarding fees for duplicate W2 forms, so be aware of your state’s rules.

- Reasonable Fees: The IRS does not regulate fees for duplicate W2 forms, but they should be reasonable.

- Avoiding Fees: Check if your employer offers free electronic access to your W2 form, as this can help you avoid fees.

Understanding the potential fees for duplicate W2 forms can help you make informed decisions about how to obtain your tax information.

How to Avoid Paying Fees

Here are some strategies to avoid paying fees for duplicate W2 forms:

- Electronic Access: Opt for electronic delivery of your W2 form, which is often free.

- Payroll Provider Websites: Check if your employer uses a payroll provider like ADP or Paychex, as they often offer free online access to your W2.

- Contact HR: Politely request a free duplicate copy from your HR department, explaining your situation.

- Cal Employee Connect: If you’re a California state employee, use Cal Employee Connect to download your W2 for free.

By taking these steps, you can often avoid paying fees for duplicate W2 forms and access your tax information at no cost.

Paying for a Duplicate W2

If you can’t avoid the fee, here’s how to pay for a duplicate W2:

- Payroll Deduction: If you’re currently employed, your employer may offer payroll deduction as a payment method.

- Cashier’s Check or Money Order: If you’re no longer employed or payroll deduction isn’t available, you may need to pay with a cashier’s check or money order.

- Payment to the State Controller’s Office: Make the check or money order payable to the State Controller’s Office.

- Avoid Personal Checks and Cash: Personal checks and cash are typically not accepted.

Understanding the payment options and following the proper procedures will ensure that your request for a duplicate W2 is processed efficiently.

Requesting a W2 From the State Controller’s Office

If you need to request a W2 from the State Controller’s Office, here’s how to do it:

- Obtain Standard Form 436: Get Standard Form 436, Request for Duplicate Wage and Tax Statement.

- Fill Out the Form: Complete the form with your personal and employment information.

- Indicate Payment Method: Select your method of payment (payroll deduction, cashier’s check, or money order).

- Submit the Form: Send the completed form and payment (if required) to the address provided on the form.

Following these steps will help you obtain your duplicate W2 form from the State Controller’s Office and ensure you have the necessary information for filing your taxes.

Close up of hands filling out a document

Close up of hands filling out a document

5. Navigating the Standard Form 436

The Standard Form 436, Request for Duplicate Wage and Tax Statement, is essential for obtaining a duplicate W2 form from the State Controller’s Office. Here’s a detailed guide on how to navigate and complete this form.

What is Standard Form 436?

Standard Form 436 is used to request a duplicate copy of your Wage and Tax Statement (W2) from the State Controller’s Office. This form is necessary if you need a copy of your W2 for previous tax years and cannot obtain it through other means.

- Purpose: To request a duplicate W2 form for tax purposes.

- Availability: Available as a fill-and-print PDF form or a printable image.

- Required Information: Includes your personal information, employment details, and the tax year(s) for which you need the W2.

- Submission: Must be submitted to the State Controller’s Office with the required payment (if applicable).

Understanding the purpose and requirements of Standard Form 436 ensures you can accurately complete and submit it to obtain your duplicate W2 form.

Where to Obtain the Form

You can obtain Standard Form 436 from the following sources:

- Online (Fill and Print PDF): Download the form as a fill-and-print PDF from the State Controller’s Office website.

- Online (Printable Image): Download the form as a printable image from the State Controller’s Office website.

- Personnel/Payroll Office: Request the form from your Personnel/Payroll Office.

Having multiple options for obtaining the form makes it easier for you to access and complete it, regardless of your location or access to technology.

How to Fill Out the Form

Follow these steps to accurately fill out Standard Form 436:

- Personal Information:

- Enter your full name, Social Security number, and current mailing address.

- Employment Information:

- Provide the name of the state agency or campus where you were employed.

- Include your employee identification number (if known).

- Tax Year(s) Requested:

- Specify the tax year(s) for which you need a duplicate W2. Note that only the four prior tax years are available.

- Method of Payment:

- If currently employed and eligible, choose “Payroll Deduction.”

- If not eligible for payroll deduction, select “Cashier’s Check” or “Money Order.”

- Signature and Date:

- Sign and date the form to certify the accuracy of the information provided.

- Submission:

- Submit the completed form along with the required payment (if applicable) to the address provided on the form.

Completing the form accurately and providing all necessary information will help ensure your request is processed smoothly and efficiently.

Payment Options

Understanding the payment options for Standard Form 436 is crucial for submitting your request successfully.

- Payroll Deduction:

- Available if you are currently employed by a state agency or campus and your position allows for voluntary deductions.

- The processing fee will be deducted from your next warrant/direct deposit payment.

- Cashier’s Check or Money Order:

- Required if you are no longer employed by a state agency or campus, or if you are unable to authorize voluntary payroll deductions.

- Make payable to the State Controller’s Office.

- Personal checks and cash are not accepted.

Choosing the appropriate payment method and following the instructions carefully will ensure your request is processed without delay.

Where to Submit the Form

Submit the completed Standard Form 436 and payment (if applicable) to the following address:

State Controller’s Office

Personnel/Payroll Services Division

P.O. Box 942850

Sacramento, CA 94250

Submitting the form to the correct address will help ensure that your request is processed in a timely manner.

6. Alternative Methods to Access Your W2

Besides the standard methods, there are alternative ways to access your W2 form. These methods can be useful in specific situations and offer additional convenience.

Check with Your Tax Preparer

If you use a tax preparer, they may already have a copy of your W2 form on file.

- Contact Your Tax Preparer: Reach out to your tax preparer and inquire if they have a copy of your W2 form.

- Provide Information: Be prepared to provide your name, Social Security number, and the tax year for which you need the W2.

- Request a Copy: If they have your W2 on file, request a copy for your records.

Checking with your tax preparer can save you time and effort, especially if you’ve used their services for several years.

Review Old Tax Returns

You may have included a copy of your W2 form with your previous tax returns.

- Locate Old Tax Returns: Find your tax returns for the relevant tax year(s).

- Check for W2 Copies: Review the documents you submitted with your tax return to see if you included a copy of your W2 form.

- Make a Copy: If you find your W2, make a copy for your records.

Reviewing old tax returns can be a quick and easy way to locate your W2 form, especially if you keep organized records.

Use Online Tax Preparation Software

If you used online tax preparation software in the past, your W2 information may be stored in your account.

- Log In to Your Account: Access your account on the tax preparation software website.

- Navigate to Tax Returns: Look for your previous tax returns and review the information you entered.

- Check for W2 Information: Your W2 information may be pre-filled or stored in your account, allowing you to access it easily.

Using online tax preparation software can streamline the tax filing process and provide convenient access to your tax documents.

Social Security Administration (SSA)

In some cases, you can obtain wage information from the Social Security Administration (SSA).

- Visit the SSA Website: Go to the Social Security Administration website.

- Create an Account: If you don’t have an account, you’ll need to create one.

- Request Earnings Information: Follow the instructions to request your earnings information, which may include W2 data.

Obtaining wage information from the SSA can be a helpful alternative if you’re unable to obtain your W2 form through other means.

Check Your Bank Statements

Your bank statements may provide clues about your income and tax withholdings.

- Review Bank Statements: Examine your bank statements for direct deposits from your employer.

- Note Deposit Amounts: Make note of the deposit amounts and dates.

- Estimate Income and Taxes: Use this information to estimate your income and taxes withheld, which can be helpful if you need to file Form 4852.

Checking your bank statements can provide valuable information for estimating your income and taxes, especially if you don’t have access to your W2 form.

7. The Intersection of Online Gaming, Esports, and Financial Literacy

As the online gaming and esports industry continues to grow, it’s essential for players and enthusiasts to understand the financial aspects of their involvement. This includes managing income, taxes, and understanding the legal and regulatory landscape.

Income and Taxes for Gamers and Esports Players

Gamers and esports players can earn income through various sources, including:

- Tournament Winnings: Prize money from esports tournaments.

- Salaries from Teams: Regular salaries from professional esports teams.

- Sponsorships: Income from sponsorships and endorsements.

- Streaming Revenue: Earnings from streaming platforms like Twitch and YouTube.

- Content Creation: Revenue from creating gaming-related content.

Understanding how these income sources are taxed is crucial for financial planning.

- Report All Income: All income, regardless of the source, must be reported on your tax return.

- Self-Employment Taxes: If you’re an independent contractor or freelancer, you may need to pay self-employment taxes.

- Deductible Expenses: You may be able to deduct expenses related to your gaming activities, such as equipment, travel, and training.

Proper tax planning can help gamers and esports players minimize their tax liability and avoid penalties.

Financial Planning for Gamers

Financial planning is essential for gamers to manage their income and achieve their financial goals.

- Budgeting: Create a budget to track your income and expenses.

- Saving: Save a portion of your income for future needs and goals.

- Investing: Consider investing in stocks, bonds, or other assets to grow your wealth.

- Retirement Planning: Start planning for retirement early to ensure financial security in the future.

Financial planning can help gamers make informed decisions about their money and achieve long-term financial success.

Legal and Regulatory Considerations

The gaming and esports industry is subject to various legal and regulatory considerations.

- Contracts: Understand the terms of your contracts with teams, sponsors, and streaming platforms.

- Intellectual Property: Protect your intellectual property, such as your brand, logo, and content.

- Gambling Laws: Be aware of gambling laws and regulations related to esports betting and fantasy sports.

- Privacy Laws: Comply with privacy laws and regulations related to data collection and use.

Understanding the legal and regulatory landscape can help gamers avoid legal issues and protect their rights.

Resources for Financial Literacy

There are many resources available to help gamers improve their financial literacy.

- Online Courses: Take online courses on personal finance, investing, and tax planning.

- Financial Advisors: Consult with a financial advisor to get personalized advice.

- Books and Articles: Read books and articles on financial literacy and wealth management.

- Websites and Blogs: Follow websites and blogs that provide financial tips and advice for gamers.

Taking advantage of these resources can help gamers develop the knowledge and skills they need to manage their finances effectively.

Gmonline.net: Your Resource for Gaming and Financial News

Gmonline.net provides comprehensive coverage of the gaming and esports industry, including financial news and resources.

- Stay Informed: Keep up-to-date with the latest financial news and trends in the gaming industry.

- Access Expert Advice: Get expert advice on managing your finances as a gamer or esports player.

- Connect with the Community: Join the Gmonline.net community to share tips and advice with other gamers.

- Find Resources: Discover valuable resources for improving your financial literacy and achieving your financial goals.

Gmonline.net is your go-to resource for staying informed and connected in the world of online gaming and esports.

8. Maximizing Your Tax Deductions as a Gamer

As a gamer, understanding and maximizing your tax deductions can significantly reduce your tax liability. Here’s a guide to help you identify potential deductions and ensure you’re claiming everything you’re entitled to.

Home Office Deduction

If you use a portion of your home exclusively and regularly for your gaming activities, you may be able to deduct expenses related to that space.

- Eligibility: You must use the space exclusively and regularly for business purposes.

- Calculation: Calculate the percentage of your home used for business and apply that percentage to your home-related expenses.

- Deductible Expenses: Mortgage interest, rent, utilities, insurance, and depreciation.

The home office deduction can be a significant tax saver for gamers who operate from home.

Equipment and Software

The cost of equipment and software used for your gaming activities may be deductible.

- Computers and Consoles: Deduct the cost of computers, consoles, and other equipment used for gaming.

- Software: Deduct the cost of software used for streaming, content creation, or gaming.

- Depreciation: If the equipment has a useful life of more than one year, you may need to depreciate the cost over time.

Properly tracking and documenting your equipment and software purchases can help you maximize your tax deductions.

Internet and Phone Expenses

If you use the internet and phone for your gaming activities, you may be able to deduct a portion of these expenses.

- Business Use: Determine the percentage of your internet and phone use that is for business purposes.

- Deductible Amount: Deduct the business portion of your internet and phone expenses.

- Documentation: Keep records of your internet and phone bills to support your deduction.

Documenting your internet and phone usage can help you claim the appropriate deduction.

Travel Expenses

If you travel for gaming-related events, such as tournaments or conferences, you may be able to deduct your travel expenses.

- Transportation: Deduct the cost of transportation, such as airfare, train tickets, or car expenses.

- Lodging: Deduct the cost of lodging, such as hotel rooms.

- Meals: Deduct 50% of the cost of meals while traveling for business.

Keeping detailed records of your travel expenses, including receipts and itineraries, is essential for claiming this deduction.

Education and Training

If you invest in education or training to improve your gaming skills, you may be able to deduct these expenses.

- Courses and Workshops: Deduct the cost of courses and workshops related to gaming.

- Coaching: Deduct the cost of coaching or mentoring from experienced gamers.

- Books and Materials: Deduct the cost of books and materials used for education and training.

Investing in your education and training can not only improve your gaming skills but also provide valuable tax deductions.

9. Staying Updated with Tax Law Changes

Tax laws are constantly evolving, so it’s essential to stay informed about the latest changes that may affect your tax situation. Here’s how to stay updated and ensure you’re compliant with the current tax laws.

Follow the IRS

The IRS is the primary source of information on tax law changes.

- IRS Website: Regularly visit the IRS website for updates, publications, and guidance.

- IRS Publications: Read IRS publications, such as Publication 17, Your Federal Income Tax, for detailed information on tax laws.

- IRS Notices: Pay attention to IRS notices and announcements regarding tax law changes.

Following the IRS is the most reliable way to stay informed about tax law changes.

Subscribe to Tax Newsletters

Many tax professionals and organizations offer tax newsletters that provide updates and analysis of tax law changes.

- AICPA: Subscribe to the American Institute of Certified Public Accountants (AICPA) tax newsletter.

- Tax Foundation: Follow the Tax Foundation for analysis of tax policy and legislation.

- State CPA Societies: Subscribe to your state CPA society’s newsletter for updates on state tax laws.

Subscribing to tax newsletters can provide timely and relevant information on tax law changes.

Consult with a Tax Professional

Consulting with a tax professional is the best way to ensure you’re complying with the current tax laws.

- Enrolled Agents: Enrolled agents are tax professionals licensed by the IRS to represent taxpayers.

- Certified Public Accountants (CPAs): CPAs are licensed accountants who can provide tax advice and preparation services.

- Tax Attorneys: Tax attorneys can provide legal advice on tax matters.

A tax professional can help you understand how tax law changes affect your specific situation and ensure you’re taking advantage of all available tax benefits.

Attend Tax Seminars and Webinars

Attending tax seminars and webinars can provide valuable insights into tax law changes and planning strategies.

- AICPA Conferences: Attend AICPA tax conferences for updates on tax law and practice.

- State CPA Society Events: Attend events hosted by your state CPA society for updates on state tax laws.

- Online Webinars: Participate in online webinars offered by tax professionals and organizations.

Attending tax seminars and webinars can help you stay informed and connected in the tax community.

Use Tax Software

Tax software is designed to incorporate the latest tax law changes, making it easier to file your tax return accurately.

- TurboTax: Use TurboTax for a user-friendly tax preparation experience.

- H&R Block: Use H&R Block for access to tax professionals and in-person support.

- TaxAct: Use TaxAct for affordable and reliable tax preparation software.

Using tax software can help you navigate the complexities of tax law and ensure you’re filing your return correctly.

10. Staying Connected with Gmonline.net for the Latest Updates

Staying connected with gmonline.net ensures you receive the latest updates on gaming, esports, and related financial news. Here’s how to make the most of our resources.

Visit Our Website Regularly

Make it a habit to visit gmonline.net regularly for the latest articles, news, and updates.

- Daily Updates: We provide daily updates on the gaming and esports industry.

- In-Depth Articles: Read in-depth articles on various topics, including financial literacy for gamers.

- Expert Analysis: Get expert analysis on the latest trends and developments in the gaming world.

Regular visits to our website will keep you informed and ahead of the curve.

Subscribe to Our Newsletter

Subscribe to our newsletter to receive the latest news and updates directly in your inbox.

- Exclusive Content: Get access to exclusive content and insights.

- Timely Updates: Receive timely updates on important news and events.

- Special Offers: Be the first to know about special offers and promotions.

Subscribing to our newsletter is a convenient way to stay connected and informed.

Follow Us on Social Media

Follow us on social media to stay updated on the go.

- Facebook: Like our Facebook page for daily updates and community discussions.

- Twitter: Follow us on Twitter for breaking news and real-time updates.

- Instagram: Follow us on Instagram for visually engaging content and behind-the-scenes glimpses.

Following us on social media is a great way to stay connected and engage with the gmonline.net community.

Join Our Community Forums

Join our community forums to connect with other gamers and esports enthusiasts.

- Share Tips and Advice: Share your tips and advice on gaming, financial planning, and more.

- Ask Questions: Get answers to your questions from experienced gamers and experts.

- Network with Others: Network with other gamers and esports enthusiasts from around the world.

Joining our community forums is a great way to connect with like-minded individuals and enhance your gaming experience.

Contact Us

If you have any questions or feedback, don’t hesitate to contact us.

- Email: Send us an email with your questions or feedback.