Switching companies in QuickBooks Online can be a breeze, especially when you need to manage multiple businesses or clients. At gmonline.net, we provide simple yet detailed instructions to guide you through the process, making financial management more efficient. Unlock the full potential of multi-company management with our expert advice on subscription plans and data separation for optimal gaming businesses and esport organizations.

1. Can You Easily Switch Between Companies in QuickBooks Online?

Yes, you can easily switch between companies in QuickBooks Online. QuickBooks Online allows users to manage multiple company files under one account, making it simple to toggle between them. This feature is essential for accountants, bookkeepers, and business owners who handle finances for multiple entities.

Switching between companies in QuickBooks Online is a straightforward process designed to enhance efficiency and streamline financial management. Whether you are an accountant managing multiple clients or a business owner overseeing several ventures, QuickBooks Online offers a seamless way to access and manage different sets of financial data. The platform allows you to maintain separate company files under a single user account, eliminating the need to log in and out repeatedly. With just a few clicks, you can navigate from one company’s dashboard to another, ensuring you stay organized and productive. This feature not only saves time but also reduces the risk of errors by keeping each entity’s financial information distinct and secure. QuickBooks Online’s intuitive interface makes the transition smooth, enabling you to focus on strategic tasks rather than getting bogged down in administrative complexities.

QuickBooks Online Dashboard

QuickBooks Online Dashboard

2. What Are The Steps To Switch Between Companies in QuickBooks Online?

To switch between companies in QuickBooks Online, follow these steps: log in to your account, access the settings menu, select “Switch company,” choose the desired company, and confirm your selection.

Here’s a more detailed breakdown:

- Log In to QuickBooks Online: Start by logging into your QuickBooks Online account using your credentials.

- Access the Settings Menu: Once logged in, navigate to the dashboard of your primary company. Look for the gear icon in the upper right corner of the screen and click on it.

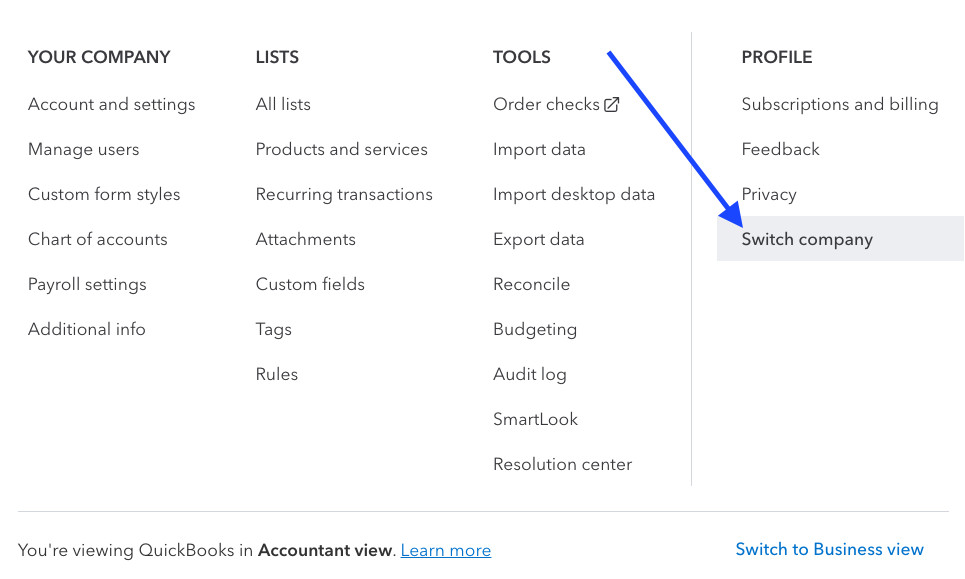

- Select “Switch Company”: In the dropdown menu, you’ll find a “Switch company” option under the “Profile” section. Click on it.

- Choose the Desired Company: A list of all the companies associated with your account will appear. This includes companies you own or have been granted access to. Select the company you want to switch to by clicking on its name.

- Confirm Your Selection: After selecting the company, QuickBooks Online will prompt you to confirm your choice. Ensure you’ve chosen the correct company to avoid any confusion.

- Begin Working in the New Company: Once confirmed, QuickBooks Online will seamlessly transition you to the selected company. You can now manage the financial data of the new company as needed.

This streamlined process ensures that users can efficiently manage multiple businesses or client accounts without any hassle. Each step is designed to minimize confusion and maintain data integrity, making QuickBooks Online a reliable tool for multi-company management. Whether you’re reconciling accounts, generating reports, or processing transactions, the ability to switch between companies effortlessly enhances productivity and accuracy. For more tips and detailed guides, visit gmonline.net, your ultimate resource for mastering QuickBooks Online and optimizing your financial workflows.

3. Why Would Someone Need To Switch Between Multiple Companies in QuickBooks Online?

Someone might need to switch between multiple companies in QuickBooks Online to manage finances for different businesses, handle client accounts as an accountant, or oversee various departments within a large organization.

Here are several reasons in more detail:

- Managing Multiple Businesses: Entrepreneurs and business owners often operate more than one company. Each business requires its own set of financial records, transactions, and reports. Switching between company files in QuickBooks Online allows users to keep these records separate and organized. For example, a business owner might run a restaurant and a retail store. Each entity has unique financial needs, and QuickBooks Online makes it easy to manage them separately.

- Handling Client Accounts as an Accountant: Accountants and bookkeepers frequently manage the finances of multiple clients. Each client has their own QuickBooks Online company file. The ability to switch between these files is essential for providing accurate and timely financial services. An accountant might handle the books for a local bakery, a law firm, and a tech startup. Each client requires individualized attention, and QuickBooks Online enables accountants to efficiently manage these diverse accounts.

- Overseeing Various Departments Within a Large Organization: Large companies may divide their operations into different departments or divisions, each functioning as a separate entity. While the company is a single legal entity, each department may need its own set of financial records for internal management and reporting. Switching between these departmental files allows financial managers to monitor performance and allocate resources effectively. For instance, a manufacturing company might have separate departments for production, sales, and marketing. Each department has its own budget and financial activities, and QuickBooks Online helps track these activities independently.

- Franchise Management: Franchisors often require franchisees to use QuickBooks Online to ensure standardized financial reporting. Switching between franchisee accounts allows the franchisor to monitor performance, enforce compliance, and provide support. A franchise operator might oversee several locations, each requiring its own QuickBooks Online file. This enables the franchisor to maintain oversight and ensure consistency across all locations.

- Real Estate Management: Property management companies often manage multiple properties, each with its own set of financial records, income, and expenses. Switching between property files in QuickBooks Online allows managers to track performance, manage cash flow, and generate reports for each property. A property manager might handle multiple rental properties, each with unique tenants, maintenance costs, and rental income. QuickBooks Online facilitates organized and efficient management of these diverse properties.

Whether you’re handling diverse businesses, managing client accounts, or overseeing departments, QuickBooks Online provides a centralized solution for efficient financial management. Explore gmonline.net for more insights and tools to optimize your QuickBooks Online experience.

4. What Are Some Tips For Managing Multiple QuickBooks Online Companies?

Some tips for managing multiple QuickBooks Online companies include ensuring proper data separation, using distinct naming conventions, setting up appropriate user roles, and leveraging reporting tools for consolidated insights.

Here’s a detailed explanation of each tip:

- Ensure Proper Data Separation: One of the most critical aspects of managing multiple QuickBooks Online companies is ensuring that each company’s financial data remains separate and distinct. Mixing data can lead to inaccuracies and compliance issues. To avoid this, always double-check which company file you are working in before entering any transactions or making any changes. Use distinct naming conventions and color-coding (if available) within QuickBooks Online to visually differentiate between companies. Additionally, regularly review transactions to confirm they have been correctly recorded in the appropriate company file.

- Use Distinct Naming Conventions: Employing clear and consistent naming conventions for each company file can significantly reduce confusion. Use names that clearly identify each business or entity. For example, instead of generic names like “Company 1” and “Company 2,” use specific names like “ABC Retail LLC” and “XYZ Services Inc.” This practice helps prevent accidental data entry errors and ensures that you and your team can quickly identify the correct company file. Consider adding location identifiers or other unique attributes to further differentiate the files if necessary.

- Set Up Appropriate User Roles: QuickBooks Online allows you to assign different user roles with varying levels of access and permissions. Properly configuring these roles is essential for maintaining data security and control. For each company file, assign user roles based on the individual’s responsibilities and the level of access they require. For example, grant full access to the accountant or financial manager, while limiting access for other employees to only the functions they need. Regularly review and update user roles to reflect changes in responsibilities or personnel.

- Leverage Reporting Tools for Consolidated Insights: While each company file contains separate financial data, there may be times when you need to consolidate financial information across multiple companies. QuickBooks Online offers reporting tools that can help you gain a consolidated view of your overall financial performance. Use features like combined reports or export data from each company file to a spreadsheet for further analysis. This allows you to compare performance, identify trends, and make informed business decisions across all your entities. Consider using third-party reporting tools that integrate with QuickBooks Online for more advanced consolidation and analysis capabilities.

Effectively managing multiple QuickBooks Online companies requires attention to detail, clear organizational practices, and leveraging the platform’s features to maintain data integrity and gain actionable insights. For more tips and resources on maximizing your use of QuickBooks Online, visit gmonline.net, where you can find expert advice and tools tailored to your business needs.

5. What Are The Benefits Of Using QuickBooks Online For Multiple Companies?

The benefits of using QuickBooks Online for multiple companies include centralized management, streamlined workflows, real-time data access, and enhanced collaboration.

Here’s a detailed look at these benefits:

- Centralized Management: QuickBooks Online allows you to manage all your company files from a single user account. This centralized approach simplifies access and eliminates the need to log in and out of multiple accounts. Whether you’re an accountant managing client accounts or a business owner overseeing multiple ventures, having a single dashboard to view and access all your companies streamlines your workflow. This centralized management also makes it easier to monitor the overall financial health of your businesses from one place.

- Streamlined Workflows: With the ability to switch seamlessly between company files, QuickBooks Online streamlines many accounting and financial tasks. You can quickly reconcile accounts, generate reports, and process transactions for multiple companies without disrupting your workflow. This efficiency is particularly beneficial for tasks that need to be performed across all companies, such as month-end closing or tax preparation. The reduced administrative burden allows you to focus on more strategic aspects of your business.

- Real-Time Data Access: QuickBooks Online provides real-time access to financial data, ensuring that you always have the most up-to-date information at your fingertips. This is crucial for making informed decisions and responding quickly to changing business conditions. Whether you’re monitoring cash flow, tracking expenses, or analyzing revenue, real-time data access enables you to stay on top of your finances across all your companies. This can be especially valuable for identifying potential issues or opportunities early on.

- Enhanced Collaboration: QuickBooks Online facilitates collaboration by allowing multiple users to access and work on the same company files simultaneously. With customizable user roles and permissions, you can control who has access to which information and what actions they can perform. This enhances teamwork and ensures that everyone is working with the same data. Whether you’re collaborating with internal team members or external accountants, QuickBooks Online makes it easy to share information and work together efficiently.

- Cloud Accessibility: Being a cloud-based platform, QuickBooks Online offers the flexibility to access your company files from anywhere with an internet connection. This accessibility is particularly beneficial for managing multiple companies, as you can stay connected and productive regardless of your location. Whether you’re traveling, working remotely, or simply need to access your financial data outside of the office, QuickBooks Online provides the convenience and flexibility you need.

Leveraging QuickBooks Online for multiple companies offers significant advantages in terms of efficiency, collaboration, and accessibility. For more information on how to optimize your use of QuickBooks Online, visit gmonline.net and explore our resources tailored to your business needs.

6. How Do Subscription Plans Affect Managing Multiple Companies in QuickBooks Online?

Subscription plans in QuickBooks Online affect managing multiple companies by determining the level of features and the number of users allowed, influencing how efficiently you can handle different entities.

Here’s a detailed breakdown:

- Features and Functionality: QuickBooks Online offers different subscription plans, such as Simple Start, Essentials, Plus, and Advanced, each with varying levels of features and functionality. The plan you choose will determine the tools available to manage your multiple companies. For example, the Simple Start plan has basic features suitable for very small businesses, while the Plus and Advanced plans offer more comprehensive tools like inventory management, budgeting, and project profitability tracking, which are essential for managing more complex businesses. Ensure that the subscription plan you select for each company file meets the specific needs of that business.

- Number of Users: Each QuickBooks Online subscription plan also has a limit on the number of users who can access the company file simultaneously. If you have multiple team members working on different companies, you need to ensure that your subscription plans allow for enough users. The Simple Start plan typically allows for only one user, while the Essentials plan allows for three, the Plus plan for five, and the Advanced plan for unlimited users. Evaluate the number of users who need access to each company file and choose a plan that accommodates them.

- Advanced Features for Complex Management: The Advanced plan includes features like advanced reporting, custom user roles, and workflow automation, which can be particularly beneficial for managing multiple companies. Advanced reporting allows you to consolidate financial data from multiple companies and gain a comprehensive view of your overall business performance. Custom user roles enable you to assign specific permissions to different users, ensuring data security and control. Workflow automation streamlines repetitive tasks, saving time and reducing errors. If you’re managing complex businesses, consider upgrading to the Advanced plan to take advantage of these features.

- Cost Considerations: Each company file in QuickBooks Online requires its own separate subscription. This means that managing multiple companies can be more expensive than managing a single company. Consider the cost of each subscription plan and factor it into your overall budget. Evaluate the features and benefits of each plan to determine which one offers the best value for each company. You may find that some companies only need a basic plan, while others require a more advanced plan to meet their needs.

- Scalability: As your businesses grow, your needs may change. Choose subscription plans that offer scalability, allowing you to upgrade or downgrade as needed. QuickBooks Online makes it easy to switch between plans, so you can adapt to changing business requirements. Regularly review your subscription plans to ensure they continue to meet your needs and provide the features and functionality you require.

Selecting the right subscription plans for each of your QuickBooks Online companies is essential for efficient and effective financial management. For expert advice and resources on choosing the best plans for your business, visit gmonline.net, your trusted source for QuickBooks Online insights.

7. How Can User Roles and Permissions Simplify Switching Between Companies?

User roles and permissions simplify switching between companies by controlling access levels, ensuring data security, and streamlining workflows for different team members.

Here’s a detailed explanation:

- Controlled Access Levels: QuickBooks Online allows administrators to assign different user roles with varying levels of access to each company file. This means you can control what each user can see and do within each company. For example, you might grant full access to the accountant or financial manager while limiting access for other employees to only the functions they need. By assigning appropriate user roles, you ensure that each team member can only access the information relevant to their job responsibilities, reducing the risk of errors and unauthorized access.

- Enhanced Data Security: By carefully managing user permissions, you can enhance the security of your financial data. QuickBooks Online allows you to specify which users can view, edit, or delete transactions, as well as access sensitive reports. This is particularly important when managing multiple companies, as you want to ensure that data from one company is not accidentally accessed or modified by someone working in another company. Implementing strong user access controls is a key step in protecting your financial information.

- Streamlined Workflows: User roles and permissions can streamline workflows by ensuring that each team member has the right tools and access to perform their tasks efficiently. For example, a sales manager might need access to customer lists and sales reports, while an inventory manager needs access to inventory levels and purchase orders. By assigning the appropriate roles, you ensure that each team member can quickly access the information they need without having to navigate through unnecessary screens or request additional permissions. This improves productivity and reduces the time it takes to complete tasks.

- Simplified Auditing: QuickBooks Online’s user role and permission features also simplify auditing and compliance. By tracking who has access to which information and what actions they have performed, you can easily monitor user activity and identify any potential issues. This is particularly useful for detecting errors, fraud, or unauthorized access. The audit log provides a detailed record of all user activity, making it easier to comply with regulatory requirements and maintain accurate financial records.

- Customized User Experience: QuickBooks Online allows you to customize the user experience based on their assigned roles. This means you can tailor the interface to display only the information and tools that are relevant to each user. This can be particularly helpful for reducing clutter and improving usability, especially for users who only need to perform specific tasks. A customized user experience can make it easier for team members to find the information they need and complete their tasks efficiently.

Effectively utilizing user roles and permissions in QuickBooks Online is essential for managing multiple companies securely and efficiently. For more tips and best practices on user management, visit gmonline.net, where you can find expert advice and resources tailored to your business needs.

8. What Common Issues Arise When Switching Between QuickBooks Online Companies and How To Solve Them?

Common issues when switching between QuickBooks Online companies include accidentally entering data into the wrong company file, confusion over which company file is currently active, and discrepancies in user access permissions.

Here are detailed solutions for each issue:

-

Accidentally Entering Data into the Wrong Company File: This is one of the most common mistakes when managing multiple QuickBooks Online companies. It can lead to inaccurate financial records and compliance issues.

- Solution:

- Double-Check Before Entering Data: Always verify which company file you are currently working in before entering any transactions or making any changes. Look for clear visual cues, such as the company name displayed prominently in the header or sidebar.

- Use Distinct Naming Conventions: Employ clear and consistent naming conventions for each company file, such as “ABC Retail LLC” and “XYZ Services Inc.” This helps prevent confusion and ensures you select the correct company file.

- Implement Data Validation Procedures: Establish internal procedures for reviewing and validating data entry. This might include having a second person review transactions before they are finalized or regularly reconciling accounts to identify any discrepancies.

- Solution:

-

Confusion Over Which Company File is Currently Active: It can be easy to lose track of which company file you are currently working in, especially if you switch between them frequently.

- Solution:

- Use Browser Tabs Effectively: Open each company file in a separate browser tab and label the tabs with the company name. This allows you to quickly see which company you are working in at a glance.

- Customize the QuickBooks Online Interface: Customize the QuickBooks Online interface to display the company name prominently. This can include changing the color scheme or adding a custom logo for each company file.

- Take Advantage of QuickBooks Online Reminders: Set up reminders or alerts within QuickBooks Online to remind you which company file you are currently working in. This can be a simple pop-up message or a notification in the dashboard.

- Solution:

-

Discrepancies in User Access Permissions: Incorrectly configured user access permissions can lead to unauthorized access, data breaches, or the inability for team members to perform their tasks.

- Solution:

- Regularly Review User Roles and Permissions: Periodically review and update user roles and permissions to ensure they align with each user’s responsibilities and the level of access they require.

- Implement the Principle of Least Privilege: Grant users only the minimum level of access necessary to perform their job duties. This reduces the risk of unauthorized access and accidental data modification.

- Use QuickBooks Online’s Audit Log: Regularly review the QuickBooks Online audit log to monitor user activity and identify any potential issues. The audit log provides a detailed record of all user actions, making it easier to detect errors, fraud, or unauthorized access.

- Solution:

Addressing these common issues requires careful attention to detail, clear organizational practices, and effective utilization of QuickBooks Online’s features. For more expert advice and resources on managing multiple QuickBooks Online companies, visit gmonline.net.

9. How Do I Ensure Data Security When Switching Between Companies in QuickBooks Online?

To ensure data security when switching between companies in QuickBooks Online, implement strong user access controls, use secure passwords, regularly monitor user activity, and enable two-factor authentication.

Here’s a detailed explanation of each measure:

- Implement Strong User Access Controls: QuickBooks Online allows you to assign different user roles with varying levels of access to each company file. This means you can control what each user can see and do within each company. Assign appropriate user roles based on the individual’s responsibilities and the level of access they require. For example, grant full access to the accountant or financial manager, while limiting access for other employees to only the functions they need. Regularly review and update user roles to reflect changes in responsibilities or personnel. This ensures that only authorized individuals have access to sensitive financial data.

- Use Secure Passwords: Encourage all users to create strong, unique passwords for their QuickBooks Online accounts. A strong password should be at least 12 characters long and include a combination of uppercase and lowercase letters, numbers, and symbols. Avoid using easily guessable information, such as birthdates, names, or common words. Implement a password policy that requires users to change their passwords regularly (e.g., every 90 days). Using secure passwords is a fundamental step in protecting your financial data from unauthorized access.

- Regularly Monitor User Activity: QuickBooks Online provides an audit log that tracks all user activity within each company file. Regularly review the audit log to monitor user actions and identify any potential security breaches or unauthorized access attempts. Look for suspicious activity, such as users accessing data outside of their normal working hours or making unauthorized changes to transactions. Investigating and addressing any suspicious activity promptly can help prevent data breaches and minimize potential damage.

- Enable Two-Factor Authentication: Two-factor authentication (2FA) adds an extra layer of security to your QuickBooks Online accounts. When 2FA is enabled, users are required to enter a second verification code in addition to their password when logging in. This code is typically sent to the user’s mobile device via text message or generated by an authenticator app. Even if a hacker manages to obtain a user’s password, they will not be able to access the account without the second verification code. Enabling 2FA significantly reduces the risk of unauthorized access and data breaches.

- Educate Users on Security Best Practices: Provide regular training to all users on security best practices for using QuickBooks Online. This training should cover topics such as creating strong passwords, recognizing phishing scams, and avoiding clicking on suspicious links. Encourage users to report any suspicious activity or security concerns to the IT department or security administrator. By educating users on security best practices, you can create a culture of security awareness and reduce the risk of human error.

Implementing these measures can significantly enhance the security of your financial data when switching between companies in QuickBooks Online. For more expert advice and resources on data security, visit gmonline.net.

10. Are There Any Limitations to Switching Between Companies in QuickBooks Online?

Yes, there are some limitations to switching between companies in QuickBooks Online, including the need for separate subscriptions for each company, potential confusion when managing multiple files, and the lack of consolidated reporting in some plans.

Here’s a detailed look at these limitations:

- Separate Subscriptions Required: One of the primary limitations is that each company file in QuickBooks Online requires its own separate subscription. This can be a significant cost factor for businesses or accountants managing multiple entities. While QuickBooks Online offers different subscription plans to suit varying needs, the cost of maintaining multiple subscriptions can add up quickly. It’s essential to factor this cost into your budget and evaluate whether the benefits of using QuickBooks Online for multiple companies outweigh the expenses.

- Potential for Confusion: Managing multiple company files can lead to confusion, especially when switching between them frequently. It’s easy to accidentally enter data into the wrong company file or lose track of which company you are currently working in. This can result in inaccurate financial records and compliance issues. To mitigate this risk, it’s important to implement clear organizational practices, such as using distinct naming conventions, color-coding company files, and double-checking the company name before entering any data.

- Limited Consolidated Reporting: While QuickBooks Online offers robust reporting capabilities, some subscription plans have limitations when it comes to consolidated reporting across multiple companies. Consolidating financial data from multiple companies can be challenging, especially if you need to generate comprehensive reports that provide an overview of your overall business performance. While the Advanced plan offers advanced reporting features that can help with consolidation, other plans may require exporting data to a spreadsheet or using third-party reporting tools.

- User Access Management: Managing user access across multiple company files can be complex. Each user needs to be granted access to each company file separately, and it’s important to ensure that users have the appropriate level of access to each file. Incorrectly configured user access permissions can lead to unauthorized access, data breaches, or the inability for team members to perform their tasks. Regularly reviewing and updating user access permissions is essential for maintaining data security and control.

- Data Migration Challenges: Switching between companies in QuickBooks Online can sometimes present data migration challenges. If you need to transfer data from one company file to another, it can be a complex and time-consuming process. While QuickBooks Online offers tools for importing and exporting data, these tools may not always be sufficient for handling large or complex datasets. In some cases, you may need to use third-party data migration services to ensure a smooth and accurate transfer of data.

Despite these limitations, QuickBooks Online remains a powerful and versatile tool for managing multiple companies. By being aware of these limitations and implementing appropriate strategies to address them, you can maximize the benefits of using QuickBooks Online for your business. For more expert advice and resources on managing multiple QuickBooks Online companies, visit gmonline.net.

FAQ: Switching Companies in QuickBooks Online

- Is it possible to manage multiple companies under one QuickBooks Online account?

Yes, QuickBooks Online allows you to manage multiple companies under a single account, but each company requires its own subscription. This makes it easier to switch between different sets of financial data. - How do I switch between companies in QuickBooks Online?

To switch companies, click on the gear icon in the upper right corner, select “Switch company” under the “Profile” section, and then choose the company you wish to access. - Do I need a separate subscription for each company I manage in QuickBooks Online?

Yes, each company file requires its own separate subscription. This ensures that each entity’s financial data is kept distinct and secure. - Can multiple users access different company files simultaneously in QuickBooks Online?

Yes, as long as each user has the appropriate permissions and your subscription plan allows for multiple users, different team members can access different company files at the same time. - What happens if I accidentally enter data into the wrong company file?

If you accidentally enter data into the wrong company file, you’ll need to correct the entry by deleting it from the incorrect file and re-entering it into the correct one. Double-checking before data entry is crucial. - How can I ensure that my financial data remains secure when switching between companies?

To ensure data security, implement strong user access controls, use secure passwords, regularly monitor user activity, and enable two-factor authentication. - Are there any reporting limitations when managing multiple companies in QuickBooks Online?

Some subscription plans have limitations on consolidated reporting. The Advanced plan offers more comprehensive reporting features, but other plans may require exporting data to a spreadsheet or using third-party tools. - Can I customize user roles and permissions for each company file in QuickBooks Online?

Yes, QuickBooks Online allows you to customize user roles and permissions for each company file, ensuring that users only have access to the information they need. - How do subscription plans affect my ability to manage multiple companies?

Subscription plans determine the level of features and the number of users allowed, influencing how efficiently you can handle different entities. - Is there a way to consolidate financial data from multiple QuickBooks Online companies?

While consolidated reporting can be limited in some plans, the Advanced plan offers features that facilitate consolidation. You can also export data to spreadsheets or use third-party tools for more comprehensive analysis.

For more detailed information and expert guidance on managing your QuickBooks Online companies, visit gmonline.net, where you’ll find a wealth of resources tailored to your business needs.

Visit gmonline.net today for the latest news, in-depth guides, and vibrant community discussions. Stay ahead with real-time updates, master your favorite games with our expert tutorials, and connect with fellow gamers in our active forums. Whether you’re seeking the thrill of competition or the camaraderie of shared interests, gmonline.net is your ultimate destination. Don’t miss out—join us now and elevate your gaming experience! Address: 10900 Wilshire Blvd, Los Angeles, CA 90024, United States. Phone: +1 (310) 235-2000.