It’s tax season, and for many, that means scrambling to gather all the necessary documents. Among the most crucial is your Form W-2, Wage and Tax Statement. This form details your earnings and the taxes withheld from your paycheck for the year. Typically, employers are required to send out W-2 forms by January 31st. But what if yours is lost, delayed, or you simply prefer to access it digitally? Fortunately, there are several ways you can obtain a copy of your W-2 online.

One of the easiest and quickest methods to get your W-2 form is often through your employer’s online portal. Many companies now utilize online systems like Cal Employee Connect for California State employees, or similar platforms, where employees can access pay stubs, tax forms, and other important employment information.

To access your W-2 online, you should:

- Check your employer’s payroll system: Log in to your company’s payroll portal or HR system. Look for sections labeled “W-2,” “Tax Forms,” or “Payroll Documents.”

- Contact your HR or Payroll department: If you’re unsure about online access, reach out to your Human Resources or Payroll department. They can guide you on how to access your W-2 online or provide a digital copy.

Accessing your W-2 online is often free and provides immediate access to your tax information. This is especially helpful if you need to file your taxes quickly or have misplaced your physical copy.

However, if online access through your employer isn’t available, or you are no longer employed by the company, you might need to explore alternative methods.

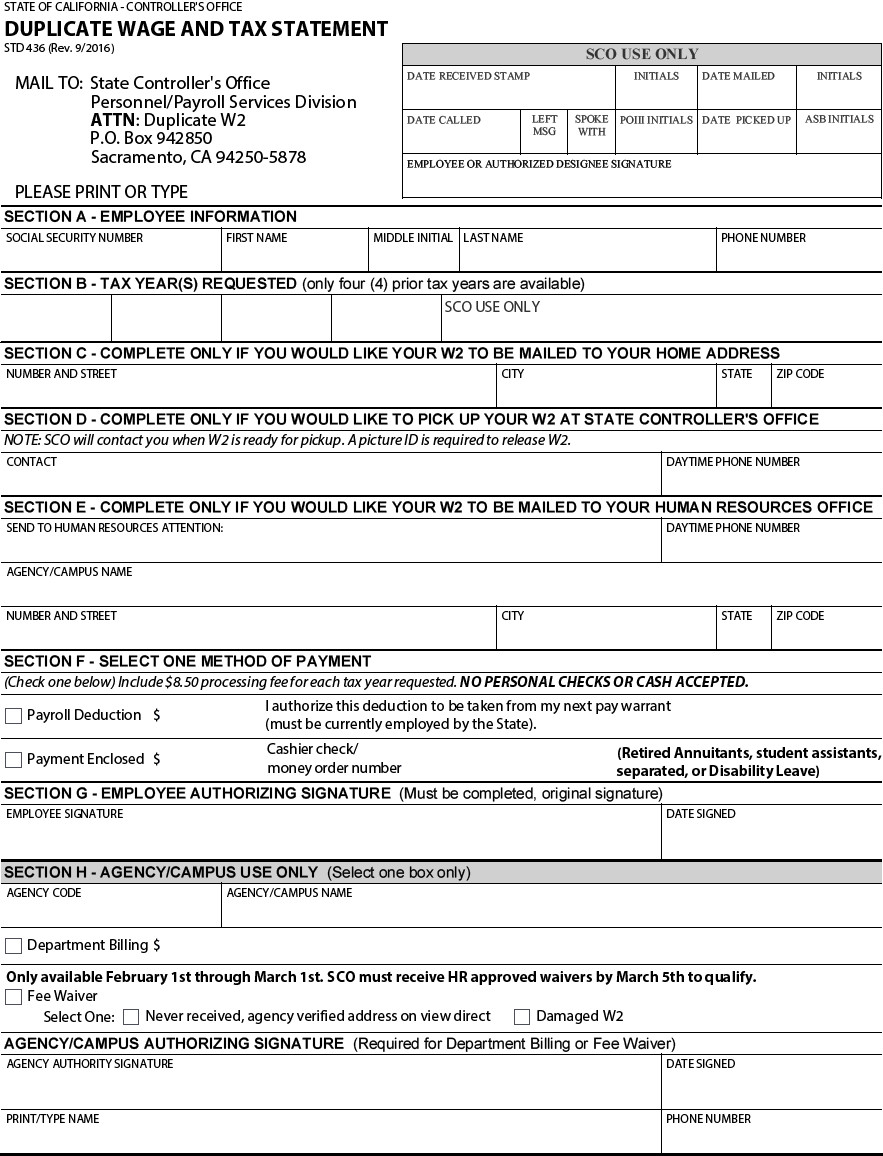

In some cases, especially if you need a duplicate copy from previous years and are a California State employee, you can request a copy from the State Controller’s Office. This process may involve filling out a form like the Standard Form 436: Request for Duplicate Wage and Tax Statement.

Standard Form 436: Request for Duplicate Wage and Tax Statement

Standard Form 436: Request for Duplicate Wage and Tax Statement

While convenient, requesting a duplicate W-2 by mail might involve a processing fee and can take several weeks to receive. For instance, the State Controller’s Office may charge a non-refundable fee per tax year requested and processing can take up to four weeks. Payment methods may vary but generally include options like payroll deduction for current employees or cashier’s checks or money orders for former employees. Personal checks or cash are typically not accepted.

In conclusion, obtaining your W-2 online is usually the most efficient way to access this crucial tax document. Start by checking your employer’s online portal or contacting your HR/Payroll department. If these options are not feasible, explore alternative methods like requesting a duplicate copy, keeping in mind potential fees and processing times. Having your W-2 readily available online simplifies tax preparation and ensures you have the necessary information to file accurately and on time.